Still, both you and your lender may wish to ensure new house you are to get is within acceptable status

FHA Minimum Possessions Requirements

To invest in a house having a conventional financial ensures that our house doesn’t need to meet with the rigorous standards other sorts of mortgages might need. It’s going to take particular solutions, however they shouldn’t be the type of repairs or so comprehensive that it will prevent you from providing a loan.

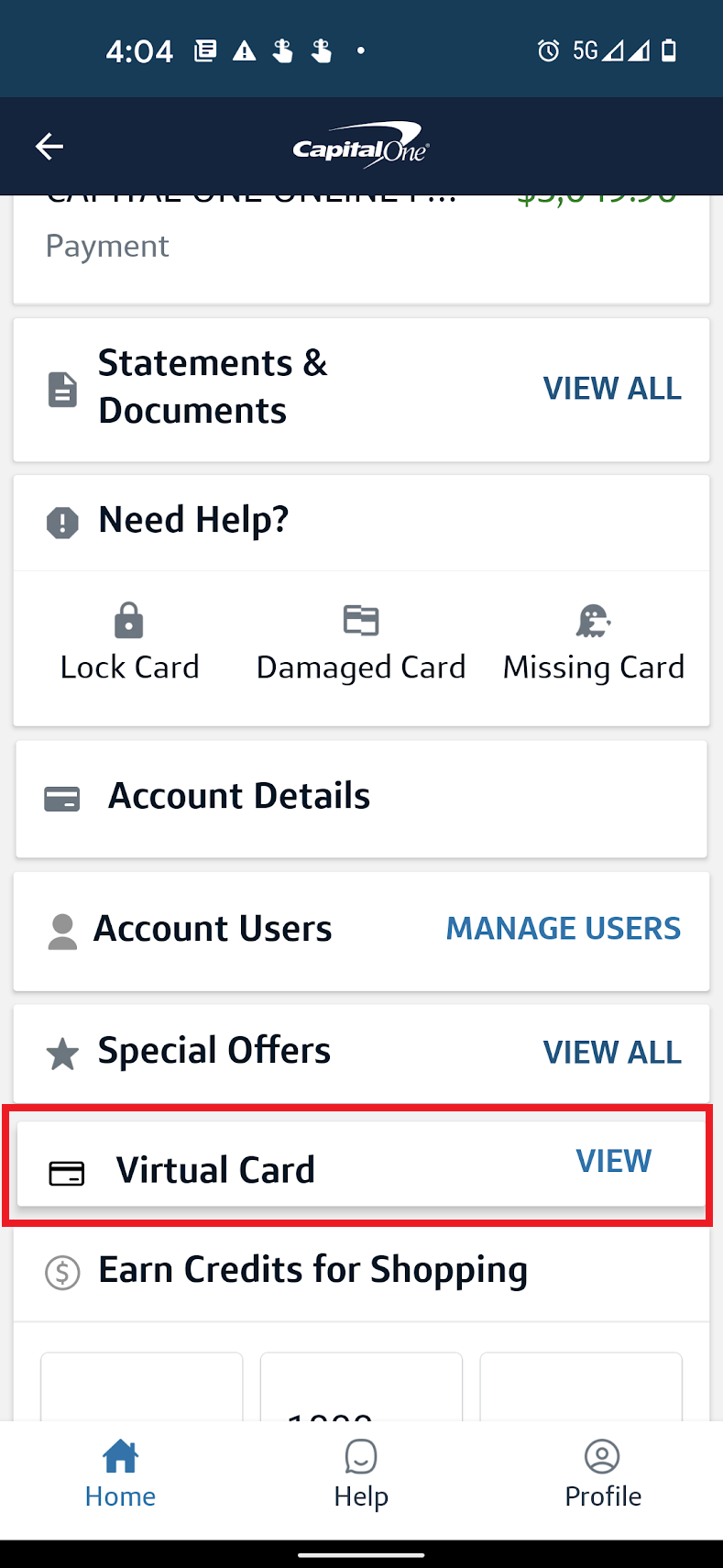

Conventional mortgage loans normally wanted a down-payment from 20% off this new appraised value of our home, however some old-fashioned finance wanted below you to definitely. Otherwise go with a traditional mortgage, you happen to be playing with an enthusiastic FHA otherwise Virtual assistant home loan, hence wanted less cash down but i have more strict legislation in regards to the updates of the property and you will possessions.

TL;DR (Long; Don’t Discover)

In the event the an assessment suggests biggest factors including a deep failing rooftop, non-functioning resources, shape otherwise direct paint, you’ll likely need to over repairs to carry on toward conventional loan.

An appraisal, Perhaps not an evaluation

Regardless of if having fun with a normal financial, the mortgage financial wants to make certain the home will probably be worth the price you are spending. The new appraiser is actually acting as this new vision of the bank. Think about, an assessment is not the same as a property assessment. A review is actually a bit more comprehensive.

Domiciles try appraised into status. That does not mean everything has to settle prime performing buy, but there are still some things that needs to be for the a great buy. There was a time when loan providers from traditional finance sensed absolutely https://clickcashadvance.com/installment-loans-ks/kansas-city/ nothing over termite repairs, however, now lenders be more cautious.

Outside Home Possess

Property status ‘s the key in the examining a property worthy of. The house would be clean and better-remaining giving a knowledgeable perception. Several other basis is the age of the home.

Lead otherwise flaking color is problematic if for example the household was oriented prior to 1978 when a number of house painting contained head. Things such as cosmetic makeup products things and style commonly allowed to be as part of the assessment, if the painting is peeling otherwise you will find openings inside the brand new wall, that will likely be an issue to own an enthusiastic appraiser. Many loan providers will need the brand new flaking paint fixed in advance of giving brand new mortgage. Any holes within the walls or floors of the home shall be fixed, and you can damaged screen will also more often than not have to be fixed.

Appraisers commonly imagine one safe practices items before suggesting the brand new home be given a conventional financing. An appraiser need anything feel fixed because a disorder prior to a loan would be acknowledged. Roof troubles are several other red-flag for appraisers. Of many banks wish to know one a roof provides at least 36 months of great working life leftover inside it.

Indoor House Features

In, an enthusiastic appraiser have a tendency to mention the amount of rooms, whether your heater and air conditioning unit really works, if for example the devices is actually present or up-to-date of course there clearly was a completed basements or a storage.

Appraisers getting old-fashioned money could have additional requirements, however, many tend to note noticeable problems. A rusted gutter or a loose floors or deck board get need to be repaired before a loan should be recognized. Some loan providers might need working cig detectors inside for every rooms, regardless of if it isn’t required by code. When there is any mildew otherwise breaks throughout the wall space, the newest appraiser may want to get in touch with a specialist in order to see the cause.

What Needs to be Repaired

When you find yourself the consumer, you can examine to see there is certainly a secure handrail to own measures and stairwells. People elevated decks need a safe railing, while next-flooring porches need a secure doorway.

All resources will likely be within the a beneficial operating buy. When the there are any plumbing problems, roof leaks or marks, ensure that the vendor keeps them fixed. Check the walls, threshold and basis to have splits. Look at the basis to be sure zero h2o was dripping through it.

Fuel is a very common reason why a financial doesn’t bring a good Va appraisal. Although you are using a traditional loan, you need to ensure that the electronic program possess adequate electricity to store the brand new house’s electrical appliances operating smoothly.

A bargaining Chip

When the property appraises at under the brand new selling price, and there’s one thing visibly completely wrong to the family, you once the customer could probably explore that looking since a real reason for owner to lower this new asking price. If you need Diy household systems, a normal home loan may allow you to purchase property inside less-than-perfect updates for lots more well worth.