six Pay day loan Credit card debt relief Solutions: Approaches to Handle Payday advances

Inside Canada, over the past season, websites actively seeks pay day loan were rising. It outnumber actively seeks any kind of financing together with mortgages, student education loans, consolidation money, and you may car loans. However, since you have most likely read, an online payday loan is actually tricky organization.

Payday loans, known as a wage advance, is a magic pill that are quite high risk. The reason why he is so popular is due to their size and you can entry to. Pay day loan is actually getting smaller amounts, he’s most an easy task to be eligible for while get money immediately.

When you are getting the income then you certainly pay back the mortgage. Audio a beneficial proper? Not so quick, there is certainly a giant hook. Such finance enjoys an average of 400% in attract.

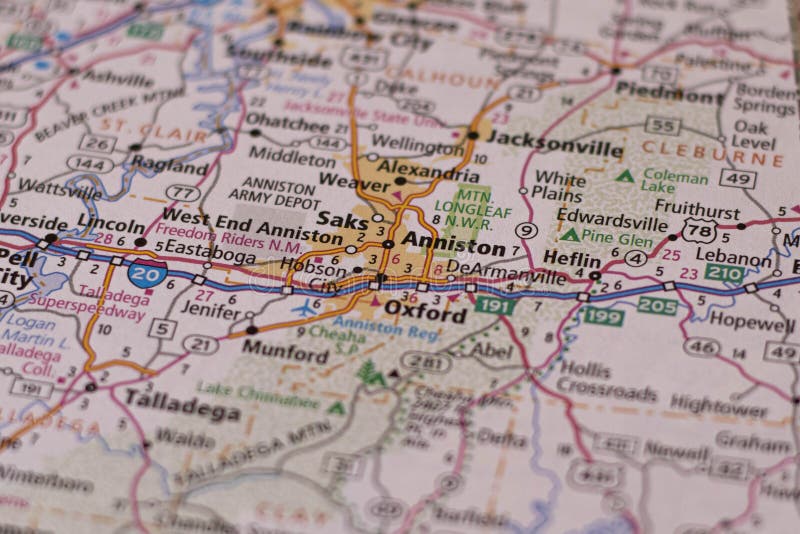

He’s marketed once the cash advances you can buy inside the a keen disaster when deciding to take you thanks to up to pay day. However, people wind up to get dependent on these types of payday fund and also make finishes meet. They contributes to a shrinking income. Monthly you’ve got https://paydayloanalabama.com/hartselle/ less to spend until eventually, the borrowed funds will be the measurements of a complete income. Many folks have started stuck inside up spiral away from loans.

These businesses try non-financial loan providers and additionally they target the fresh economically insecure one of society. He or she is designed to be taken over to a brief period of your energy however, pages have a tendency to get caught of the unforeseen charge. On top of that, even more you to short time new 400% notice really can add up. By way of example, financing off $five hundred becomes $a lot of more a-quarter seasons. That’s one hundred% interest in merely 3 months!

Cash advance have also has just become popular in the yet another demographic. For those who have a young child from inside the college you must know one young students who’ve student loans today use pay day loan at a stunning speed. Students obtain education loan monitors during the lay times. But sometimes it happens too late to possess fundamentals that they you would like eg area and you may board. Thus, they consider the fresh new magic bullet of the wage advance.

These funds have an instant turnaround time for repayment and you can costly charge. That it often grabs as much as its financially vulnerable target audience. Instead of helping they often plunge the user toward better loans.

The fresh new pay day loan feels like getting a ring-services for the an unbarred injury. It is a magic bullet, maybe not a long-term provider.

Regarding podcast lower than, the Signed up Insolvency Trustee, Matthew Fader tackles payday loan, the dangers in the him or her, while the cash advance debt relief choice they give in order to customers.

My personal Cash advance Has-been An unmanageable Personal debt Exactly what Ought i Perform?

In case the own payday cash possess acquired uncontrollable they tends to be time for you to look for personal debt help. There are numerous methods that lightens your of the expenses. Step one is to look for a licensed Insolvency Trustee, otherwise Lit to possess small. Talking about obligations and you will personal bankruptcy benefits registered inside the Canada. They’re going to get acquainted with your debts thereby applying one of several adopting the strategies:

step one. Borrowing from the bank Counselling

Borrowing therapy provides studies toward proper money government. They provide advice and pointers that helps you with budgeting. They educate you on how to safely have fun with debit and you can credit cards. Lastly, borrowing guidance can help you follow the debt cost package.

2. Obligations Administration

A keen Illuminated can help you would a loans administration bundle. He or she is designed for people who can invariably repay its debts more a longer period of time. Your own un-secured debts try pooled together into you to payment that is split between your creditors.