Construction Financing A very Large Charge card

What exactly is a homes Financing?

What is actually a casing mortgage? Would I would like they buying belongings? Perform I need one ahead of We invest in building a custom made family? We will are address those concerns right now.

Basic, a casing financing is definitely not exactly like a mortgage! That’s a very important point out learn if you find yourself trying to generate a custom-built home in Denver, Boulder, Texas Springs, or everywhere even! A lot of people get this idea that one mortgage broker perform a casing financing which can be of course Completely wrong! You’ll find most likely a number of home loan professionals available just who might render build finance, however, In my opinion they are rare.

All the framework financing that individuals discover is actually loans originating from the a financial. Our taste from the HomeWrights Customized Property is always which have a district lender. We think local banks carry out the best jobs. While i state local lender. What i’m saying is a lender having roots right there in your society. Whether you are inside the Boulder, Denver, otherwise Colorado Springs look for a district bank that knows your neighborhood. Most of our very own Manager-Creator subscribers focus on regional loan providers.

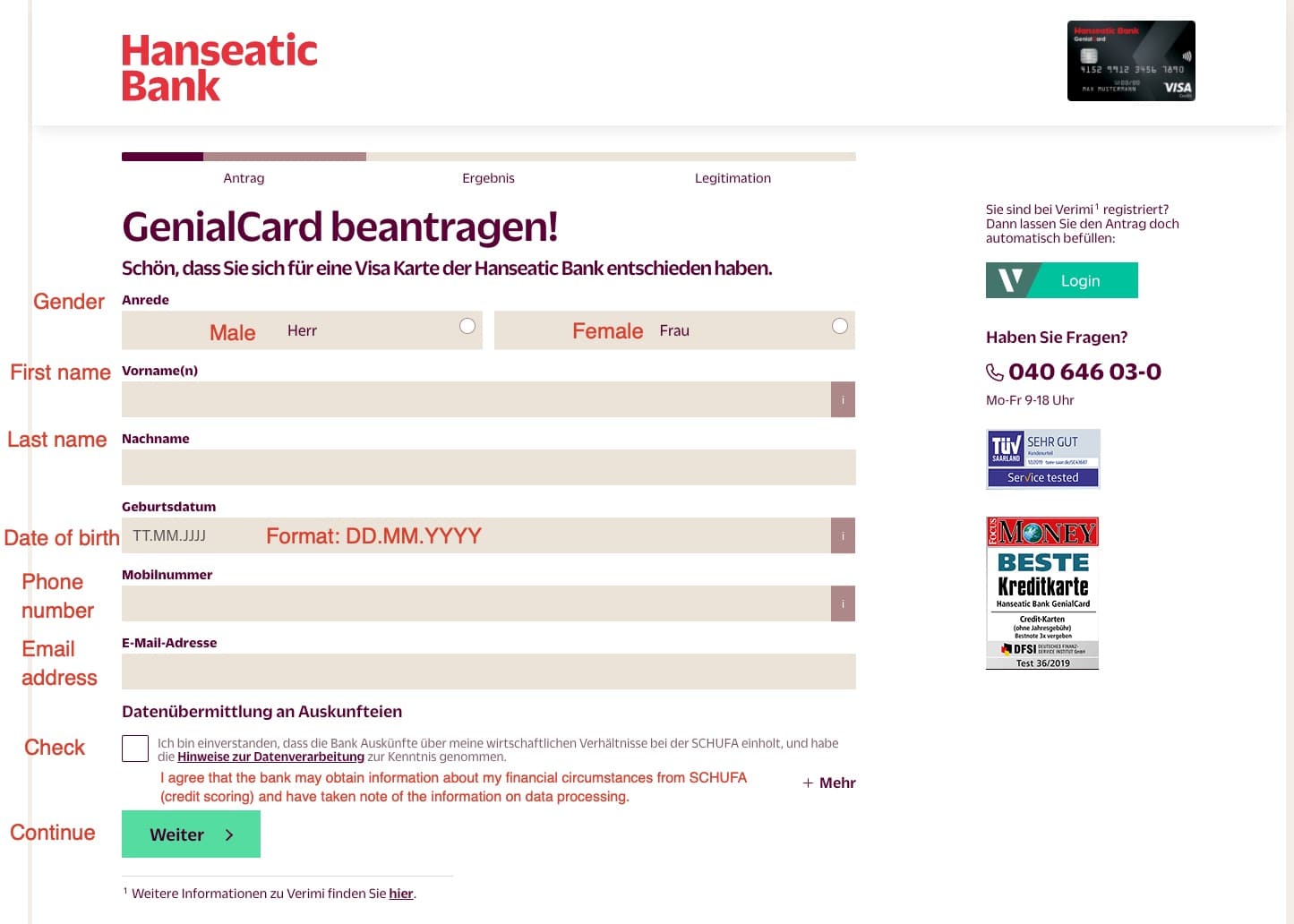

The key to know would be the fact a housing mortgage was most an extremely large line of credit. In a few implies, its particularly a credit card. You have X amount of cash reserved on how to create your custom home, your borrowing limit. And often, together with men and women cash they’ve to own actual framework, they’ll and additionally reserved specific bucks to essentially shell out focus thereon loan during the construction.

Thus there clearly was an excellent opportunity that your particular design financing often end up being organized in a sense that you will not build out-of-wallet repayments during build. The financial institution would be and make those people costs for you. Not forgetting, these are generally incorporating that into the total number of the development mortgage.

You are not planning provides duplicate payments.

Thus at some point in big date, the Piper will have to be repaid, but it is a means to get custom home centered rather than being required to generate monthly premiums. I think that’s, that’s a tremendously extremely important point for all those knowing would be the fact you can stay 2022 direct express emergency cash in your house and create your new house or apartment with your own build loan. You’re not going to provides content repayments.

First Differences when considering Design Money And you may Mortgages

- Period of time: Normal house structure loans try short-title contracts you to fundamentally last for regarding a-year. Home financing have different terminology and offer you any where from 10 to help you three decades to pay off. A mortgage isnt always available for the structure even when certain loan providers possess particular crossbreed tools that provide a combination off one another.

- Installment Charges: Build funds try short-title monetary equipment plus don’t penalize you to own early installment of the balance. Mortgages may have charges having very early payment. Penalties, if any, may include financial to lender.

- Appeal Money: Framework funds costs focus towards level of the borrowed funds utilized throughout the merely inside the construction process. In case the entire number allocated is not made use of, brand new borrower doesn’t pay the entire notice amount. Mortgage loans costs the borrower attract towards complete number of brand new mortgage.

- Belongings Instructions: Structure loans offer brand new home builders into upfront finance requisite to find home on which to build. Regular mortgage loans do not generally make it belongings instructions.

- Framework Rates Repay: Kept can cost you from custom-built home design can be paid by acquiring a mortgage towards the finished home. The latest terms of the financial range between financial so you’re able to lender so shop around. Financing origination costs, interest levels, and you can level of monthly installments are different. Particular terms try negotiable during the a competitive sector.

I think this is certainly an extremely extremely important variation and come up with throughout the construction. The construction loan could well be increasing as well as the very first day your may only are obligated to pay $fifty,000. By the 8th week or ninth week otherwise 10th day, you are able to owe 350,000 or five hundred,000 or 700,000 otherwise $800,000 on your own design loan. When your bespoke home is performed with all of the design you could potentially buy a mortgage lender that will up coming shell out out of one to build financing. The development loan merely goes away completely. It is paid off by your new home loan.

Top Notice: If you’re planning to behave since your own general builder along with hardly any feel, really lenders are likely to timid of providing you a framework mortgage. Why? They cannot risk placing out significant currency for an individual which you’ll struggle with it allows or perhaps is incapable of get the subcontractors to obtain the job done in a timely and you can quality style.

To put it differently, they need to learn he could be financing a housing venture one to is going to have completed securely. That is why HomeWrights Manager-Builder subscribers keeps a far greater threat of delivering a construction financing due to the fact bank understands HomeWrights enjoys a proven reputation at the rear of its readers in order to a successful outcome.

Build Loan Choices

You will find some products available to choose from, named one to-day personal funds. That sort of framework loans and also automatically transforms into an excellent home loan. We are not on credit providers very you’ll want to shop for this sorts of tool.

Whenever you are you aren’t good credit and you can a decent business records, after that searching may repay for you since finance companies are seeking people with a good credit score and you may people having a a good work history. It love to generate one to construction financing and it’s really perhaps even it is possible to so you’re able to negotiate into those people construction loans. Perhaps you will get the pace off or reduce the origination charge off somewhat. All of the bit support when you are strengthening a bespoke home!

Build credit is a little piece of a complicated concept and you can we have been usually thrilled to display any pointers we have about the subject. Please call us and we’ll become happier to express whatever we can. If we cannot reply to your matter, we could yes point in brand new advice of somebody that will!

As to the reasons HomeWrights Personalized Property?

Every custom home is unique and you will HomeWright’s keeps a group of elite designers to work alongside your as you build riches to own the next from the acting as your own custom home creator.

Regardless if you are taking advantage of our very own Manager-Builder system or our very own Turnkey method to strengthening your own bespoke home, recognizing the necessity of setting goals and achieving clear motives commonly generate one excursion to your fantasy family much much easier!