As bodies backs USDA money and Va finance , they generally have down interest rates than just traditional loans

click to read

But not, the interest rate you have made relies on the lender you select, your earnings, your credit rating, the newest down payment number, the borrowed funds term, or any other products.

If you get a good USDA loan, you have to pay a single-go out step one% make sure payment and an effective 0.35% annual commission (energized monthly). That have a Virtual assistant mortgage, you need to pay an effective Virtual assistant resource payment that varies from 0.5% to three.3% of one’s amount borrowed. Even though you take good Va loan before and the down payment you make provides a positive change into capital commission you have to pay.

For example, when you’re getting an effective Virtual assistant financing the very first time and you will make a beneficial 5% downpayment, you’ll need to spend dos.15% because the financing commission. If your deposit increases to ten% or maybe more, the brand new money payment drops to 1.25%. If you have put a good Virtual assistant financing previously and work out good 5% down-payment into the your new Va mortgage, you pay an effective step three.3% investment commission, and it also decrease to just one.25% if one makes a deposit off ten% or maybe more.

No matter which type of mortgage you have made, you also need to make up closing costs . These could are located in the type of software costs, financing origination charges, appraisal fees, attorneys charge, price lock fees, and you will underwriting fees.

Financial Insurance coverage

The newest advance payment you create on a conventional home loan influences whether you have to pay extra to have private mortgage insurance rates (PMI). If the down-payment try lower than 20% of your own house’s selling price, you ought to get PMI. That it resides in set until you generate at the very least 20% collateral in your home.

Regarding home loan insurance coverage, this may are available that the USDA financing vs. old-fashioned mortgage review tilts the balance in support of the previous. Yet not, while you are USDA money do not require one to spend extra for home loan insurance , you pay a yearly ensure commission that’s generally integrated on your monthly mortgage repayment. Their lender then pays this payment towards the USDA.

Brand new Va loan vs. conventional loan research is not too some other getting home loan insurance coverage. Although you don’t have to spend more for home loan insurance coverage in the event that you get a Virtual assistant mortgage, you need to pay a funding commission that your financial charge while the a percentage of your own amount borrowed. You may spend that it from the closure or inside your monthly home loan repayments.

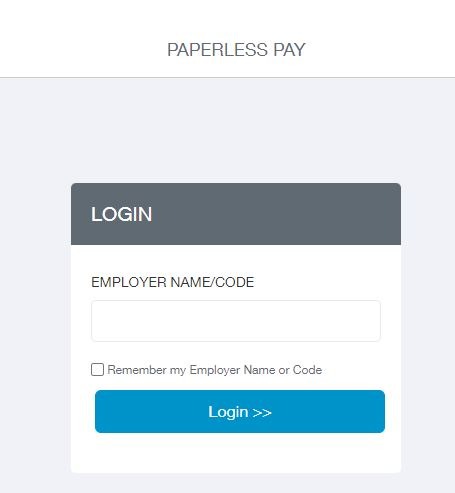

Applying for a mortgage

You are able to make an application for a beneficial Virtual assistant loan as a result of people lender your find just after taking a certification out-of Eligibility (COE) , that you may receive on line, through send, or during your bank. Should you want to get a beneficial USDA financing, you should limit your browse into department’s range of acknowledged lenders. You have made much more lenders from which to choose for many who decide to submit an application for a normal financing.

Search Preapproval

Consider this shortly after seeking your perfect family, you narrow down on one one to costs $750,000. But not, after you get a mortgage, the thing is out you meet the requirements to borrow merely $five-hundred,000.Providing preapproved provides you with an indication of how much cash good bank is actually prepared to lend for you hence gives you the ability to discover house consequently. Besides, good preapproval suggests to help you a seller you are seriously interested in the processes and have the backing away from a lender.

Recall, though, one a good preapproval doesn’t incorporate a hope since your bank carry out feedback their creditworthiness whenever performing new underwriting process too.