Just how to pay student education loans prompt

While college loans is going to be a helpful equipment to possess investing in college or university in the us, they could end up being a primary economic burden after you scholar. If you find yourself ready to have that month-to-month student loan percentage away of your life, there are ways to pay-off student loans reduced.

Quickening the debt repayment may not be effortless, nonetheless it could well be worth the sacrifices ultimately in the event the it’s possible to decrease your figuratively speaking before schedule.

When you’re curious simple tips to pay-off figuratively speaking fast as the a global pupil, below are a few methods which will let:

1. Refinance to possess a reduced rate of interest

If you’re looking to settle your own student education loans shorter, you could potentially think refinancing the global college loans which have a loan provider based in the Us. For those who refinance education loan debt, you could get a reduced interest.

As less of your money could well be probably attract, you may be able to manage most money on your own refinanced mortgage. Of several refinancing loan providers about You.S. you should never charge a beneficial prepayment penalty, you will most likely not need to worry about racking up people prepayment charges both.

Certain lenders provide even more speed coupons if you make to your-time money otherwise sign up for automated costs. MPOWER Financial support , like, also offers an excellent 0.50% rates reduce for individuals who place your refinanced student loan towards autopay and an additional 0.50% price disregard once you have generated half a dozen consecutive payments playing with autopay.

Getting this type of tips to attenuate their interest around you’ll could help build your loan inexpensive because you functions to invest it off quicker.

dos. Spend over the minimum fee

Once you obtain a student-based loan, you always invest in pay it back that have fixed monthly installments more than a certain number of decades. But if you pay more the minimum matter due each day, you could potentially shave days or even decades away from your payment identity.

Such, what if your grabbed a good $thirty-five,one hundred thousand financing on a % rates. For people who spend $463 per month, you’ll receive gone you to definitely loans when you look at the ten years. But if you is also bump their monthly payment around $513 ($50 alot more monthly), you’re going to get out-of personal debt per year and a half less and you may cut nearly $step three,500 in the attention. If you possibly could pay $563 per month, you’re going to get eliminate the debt a couple of years and you may seven months smaller and conserve almost $six,100000 in appeal costs.

Before starting the increased payments, it can be worth contacting the loan servicer so you’re able to guarantee that its applying the payments precisely. We would like to make sure that your money are getting for the your own dominating balance in the place of being spared to own upcoming expense.

3. Look for a career having student loan recommendations

Some people offer student loan guidance benefits to their workers. Yahoo, such as for instance, usually complement so you’re able to $2,five-hundred inside student loan repayments per year because of its team. And technical team Jacksonville installment loans Nvidia pays up to $six,100000 per year into the student loan help with an existence limit of $29,000.

If you’re looking for an alternate occupations, believe prioritizing a family to help you pay back their student loans. Keep in mind that global student education loans aren’t always qualified to receive it work for – you may want to refinance your student loans with a great You.S.-created lender to be eligible for manager-sponsored student loan advice.

4. Make biweekly costs

When you find yourself and come up with monthly student loan payments, imagine switching to biweekly repayments. To phrase it differently, broke up your own invoice in half and you will shell out one count all two weeks. As opposed to paying $2 hundred once per month, instance, you’ll pay $one hundred all of the 14 days.

You can easily nevertheless spend the money for exact same count each month, however, on account of how diary ends up, you will be and come up with a complete a lot more percentage yearly. To make biweekly repayments on your figuratively speaking is a straightforward way to settle the debt quicker without a lot of more energy to the your part.

5. Require a boost or work a side hustle

And make most repayments in your student education loans will be difficult if the you do not have any area on your budget. Whenever you are purchased reducing the debt in advance of schedule, try to find a way to improve earnings.

You could potentially request an improve from your own manager or work an area hustle, like riding to possess a journey-discussing solution otherwise giving self-employed characteristics on line. If you can boost your earnings, you might implement you to definitely more money on settling your college student mortgage personal debt.

6. Lower your living expenses

As well as increasing your income, consider an approach to reduce your costs. Releasing right up extra space in your funds will help you manage most payments on your student education loans.

Consider downsizing in order to a less costly apartment otherwise relocating having an excellent roomie or one or two. For people who tend to eat out at the restaurants, try buffet believe and preparing in the home. Just in case the car payment is an increase, consider exchange on the auto to possess a less costly vehicles.

Check the month-to-month expenses to identify places that you might reduce. Also an additional $fifty or $100 a month could help pay-off your figuratively speaking shorter.

seven. Put a money windfall into the your own money

For many who discovered an unexpected windfall of cash, such as a plus at the job or heredity, it might be tempting to blow they on the some thing fun. In case you might be purchased reducing the college student obligations as quickly as possible, believe placing one to windfall to your your figuratively speaking.

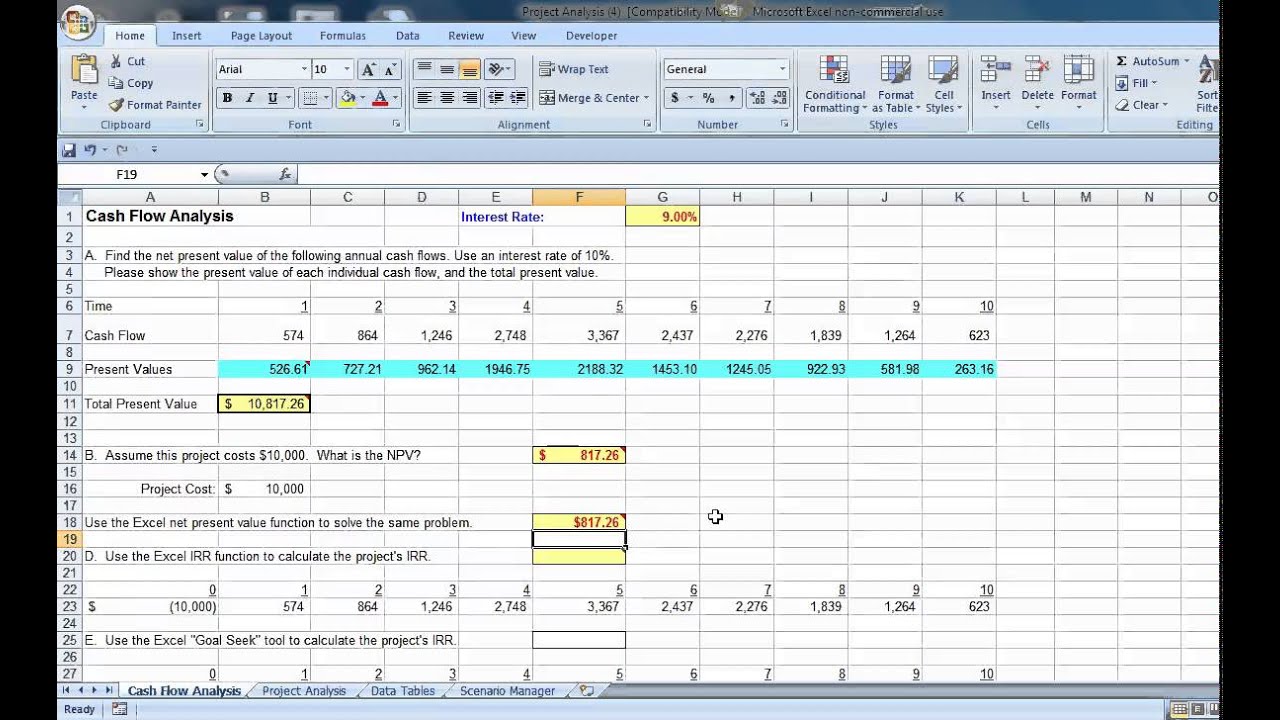

If you’d like an improve off desire, have fun with a student-based loan calculator observe just how much a supplementary commission carry out help save you. Because of the seeing just how much you might conserve for the attract, as well as the date you might shave off your debt, you could feel driven to adhere to your debt cost requires.