However, because they are substantially riskier, loan providers typically implement very rigorous standards when examining candidates to own zero-put mortgage brokers

Post conclusion

- Finance companies https://paydayloanalabama.com/sardis-city/ generally speaking apply very rigorous requirements when examining family-mortgage people who have no-deposit since they are believed substantially riskier.

- Plain old requirements to own no-deposit individuals are priced between a flush credit score, a powerful repayment history, stable work and you may a simple types of and you will location out of prospective property.

- Guarantor loans are perfect for borrowers who’ve a consistent borrowing ability and you may earnings, however, do not have the ways to gather the original deposit.

For many of us, buying a home belongs to the nice South African fantasy. Yet to your higher cost-of-living, rescuing to have a deposit can be extremely difficult.

Indeed, for people who end up in this category from homebuyer, you’re not by yourself. Nearly half all of the apps gotten from the ooba are from people who’ve no use of in initial deposit, states Kay Geldenhuys, Assets Funds Running Manager within Southern area Africa’s premier thread inventor.

Surprisingly, it is far from impossible to rating a hundred% money. In reality, a serious 74% otherwise three-out regarding five your individuals try winning in protecting a no-put thread, since other individuals must improve a comparatively small put, essentially just one that is anywhere between four and you may ten% of one’s cost.

Geldenhuys shows you that people that get no-put fund was very first-go out buyers that will reside in the brand new land they buy. Banking companies favor such people while they usually spend its funds promptly.

It is possible to get approved for a loan out-of a hundred% of one’s purchase price of a property when you can meet specific conditions. Right here, Geldenhuys explains plain old conditions with no-put borrowers:

Pristine credit rating

You really must have a clean credit history and you will credit history. Southern African banking companies dont create conditions compared to that plan from inside the times and no-put loans from the courtroom standards to allow them to give sensibly.

Good repayment background

You ought to reveal that you have been expenses your money and expense straight back punctually. Most of the charge card payment, car loan, and you can fast rent percentage can help you encourage banking institutions you to definitely you’re a responsible debtor.

Secure a career money

You really must have a constant, constant jobs giving an income sufficient that you can manage to pay back the loan. Masters in a few employment (elizabeth.g. accounting firms, attorneys, doctors) tend to be very likely to become approved for a home loan and no deposit as they are fundamentally said to be in the a diminished likelihood of shedding its perform.

Location and assets method of

Lenders tend to be more going to grant a zero-deposit mortgage to someone who is wanting buying a property during the a routine urban area, such a money area, and property shouldn’t be unusual in other words, it should be a standard family, townhouse, apartment or empty belongings to construct into the.

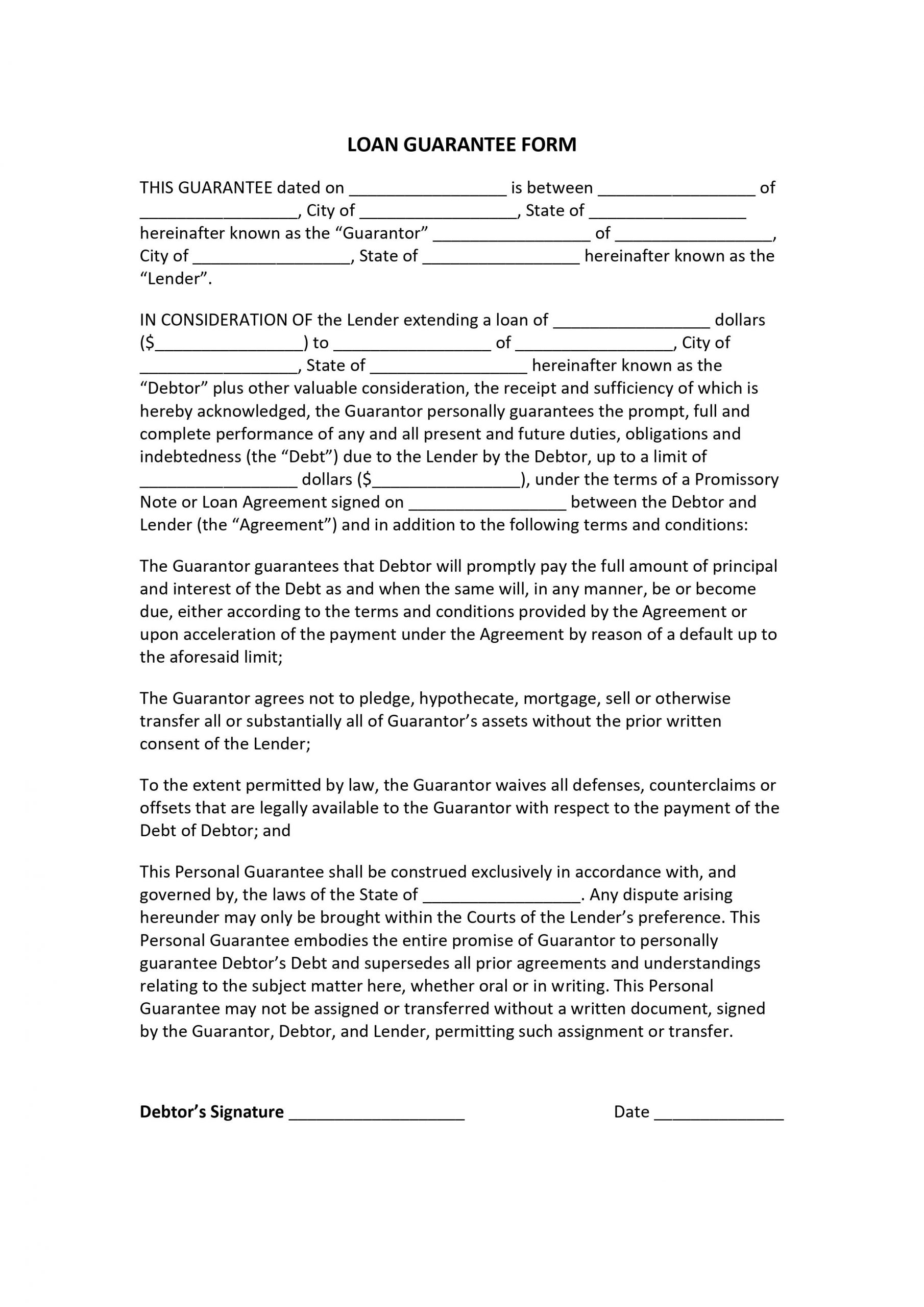

A guarantor into mortgage

An excellent guarantor are people with a current possessions who’s legitimately guilty of trying to repay the entire mortgage if you can’t create the mortgage payments and also will have to pay any costs, charges and you can notice. A father get try to be a great guarantor to help you first-big date customers seeking to let providing a home loan. The newest guarantor may use their property as the safety for as long as the worth of the protection is great sufficient this means that, the latest guarantor has to have a certain amount of collateral when you look at the their property, that’s a sureity against the mortgage should you can not satisfy otherwise create your payment debt within the loan bargain.

While they established relationship towards financial institutions and are also ready to negotiate the best deal on your behalf, formal thread originators, such as ooba, can also be somewhat improve your likelihood of bringing a thread with little or no put.

To help make the home-to shop for procedure that smoother, Southern area Africa’s top bond originator also offers a range of financial calculators, including those that influence thread cost and you can bond costs.