The financial institution will designate underwriters and processors to ensure new guidance you filed

Loan underwriting is just one of the final yet https://paydayloancolorado.net/victor/ crucial stages in brand new Va home loan software. Financing underwriting initiate after you publish your articles and purchase price on the lender’s site.

Get a closing Revelation

The borrowed funds closure ‘s the latest help the loan software techniques. In loan closure, the home officially transfers on the merchant for you.

In advance of following, the lender usually procedure an ending disclosure showing the closure prices for the property. The latest closing disclosure comes with the loan installment words and you can requested month-to-month repayments.

You might contrast the past closing prices towards the loan estimates conveyed on the pre-recognition page. You can even require explanation if anything actually sure of new document.

Into the closing, the lender may also ask finally questions about your earnings and find out if you might pay the loan. You may then discovered good ‘clear so you’re able to close’ buy, enabling you to agenda the right closing time.

End up being a homeowner

The mortgage closing generally speaking demands you to definitely counterbalance the closing costs. A-one-date Virtual assistant financing fee (0.4%-step three.6%) is even required to keep the Va financing system.

When you obvious this new payment, you may be just one step away from to be a citizen. The true home representative takes you due to a last vision-viewing of the home you want to get so that you verify advised repairs is actually high enough. In the end, it is possible to signal new closing documents and get another resident.

Va Financing Rates of interest

The fresh veterans’ points agency does not influence the eye rates recharged for the Va funds. Instead, banking companies, credit unions, or other creditors set the financing cost.

Financial Cycle – You can choose a great 15-seasons otherwise 29-12 months loan identity, dependent on their contract toward lender. A fifteen-year identity keeps high monthly premiums, a smaller stage, and you will a lesser interest rate. On top of that, a thirty-12 months term features quicker monthly installments and you may a top interest due to the fact chance of standard is much highest.

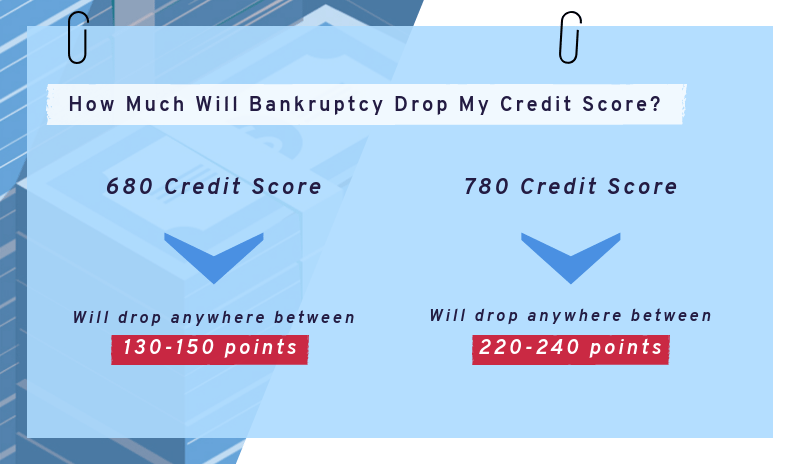

Credit score – The newest Service of Pros Items has no the absolute minimum credit score for individuals to find financing. not, private lenders has minimal credit rating constraints required to obtain the loan. Although credit history criteria will vary, most loan providers want the very least get off 620 to locate a beneficial Va financial.

Sorts of Mortgage – There are five large types of Virtual assistant mortgage loans – Jumbo money, Repair money, Re-finance loans, High efficiency fund, and you will Interest rate Protection Finance. The interest pricing can vary according to the loan tool your like.

- Field Conditions – The present economic conditions on the mortgage business provides a primary effect on loan rates of interest. For example, if your Government Reserve kits a premier loans price, finance institutions usually borrow money in the a higher rate. The mortgage interest levels also rise to pay for the highest federal fund price.

Benefits associated with Virtual assistant Mortgage

A Va financial offers unbelievable masters not utilized in conventional mortgage loans. Because of its enormous benefits, the borrowed funds is a wonderful option for of numerous veterans and you can service people searching for a property.

No Downpayment

The brand new deposit exclusion is one of extreme benefit of bringing a Virtual assistant Mortgage. You can purchase the mortgage versus a single initial commission in the event the your meet the VA’s standards.

The new zero advance payment term was a bonus if you wish to acquire a home in the place of investing much time-saving money to own a down payment.

Zero Private Mortgage Insurance (PMI)

When taking a traditional mortgage, loan providers will need you to pay PMI in case the down payment try below 20% of one’s overall household price. This new PMI handles the financial facing monetary losses or even prize their financing personal debt.