ten.Deciding on the best Financial for your Assessment-Totally free Family Collateral Mortgage [Unique Blogs]

How the funds from a home equity loan are utilized can indirectly impact the interest rate. Lenders might offer more favorable rates if the funds are used for home-related investments, such as renovations or repairs, as these investments can potentially increase the property’s value. Conversely, using the funds for non-appreciating possessions or large-exposure ventures might result in higher interest rates.

Of several borrowers undervalue the power of discussion. Loan providers tend to contend to possess customers, and you can individuals must not hesitate to discuss the new terms and conditions, for instance the interest, costs, and you will repayment terminology. Are really-told throughout the prevailing sector prices and achieving a strong credit history can also be fortify the borrower’s status throughout the dealings, potentially ultimately causing a much better contract.

A lender who is receptive and supportive on mortgage process makes a difference in your overall experience

Economic locations are state-of-the-art and actually ever-modifying. It’s critical for borrowers to keep informed regarding the sector fashion and constantly evaluate its loan alternatives. Seeking suggestions out of financial experts otherwise mortgage masters offer rewarding facts customized in order to personal things.

Managing home equity loan rates demands a proactive approach and a deep understanding of the factors influencing interest-sensitive liabilities. By employing these strategies and staying vigilant in the vibrant economic land, borrowers can optimize their home equity loans, ensuring favorable rates and a safe monetary upcoming.

In terms of selecting the right bank for your appraisal-100 % free domestic security mortgage, it is essential to make sure to assess your circumstances and research the available options. Start by given what you want the borrowed funds getting and just how far you are looking so you’re able to obtain. Will you be planning make use of the financing having a house repair project, debt consolidation reduction, otherwise education expenditures? After you’ve an obvious knowledge of your needs, initiate evaluating lenders just who provide appraisal-free domestic equity money.

One of the most important factors to consider when choosing a lender for your appraisal-free home equity loan ‘s the rate of interest and loan terms they offer. Different lenders may have varying rates and terms, so it’s crucial to compare multiple options to find the most favorable terms for your financial situation. Look for lenders who offer competitive interest rates and flexible repayment options that align with your budget and timeline.

Experts can be get to know specific financial situations and you can strongly recommend tailored strategies to do household security mortgage costs effortlessly

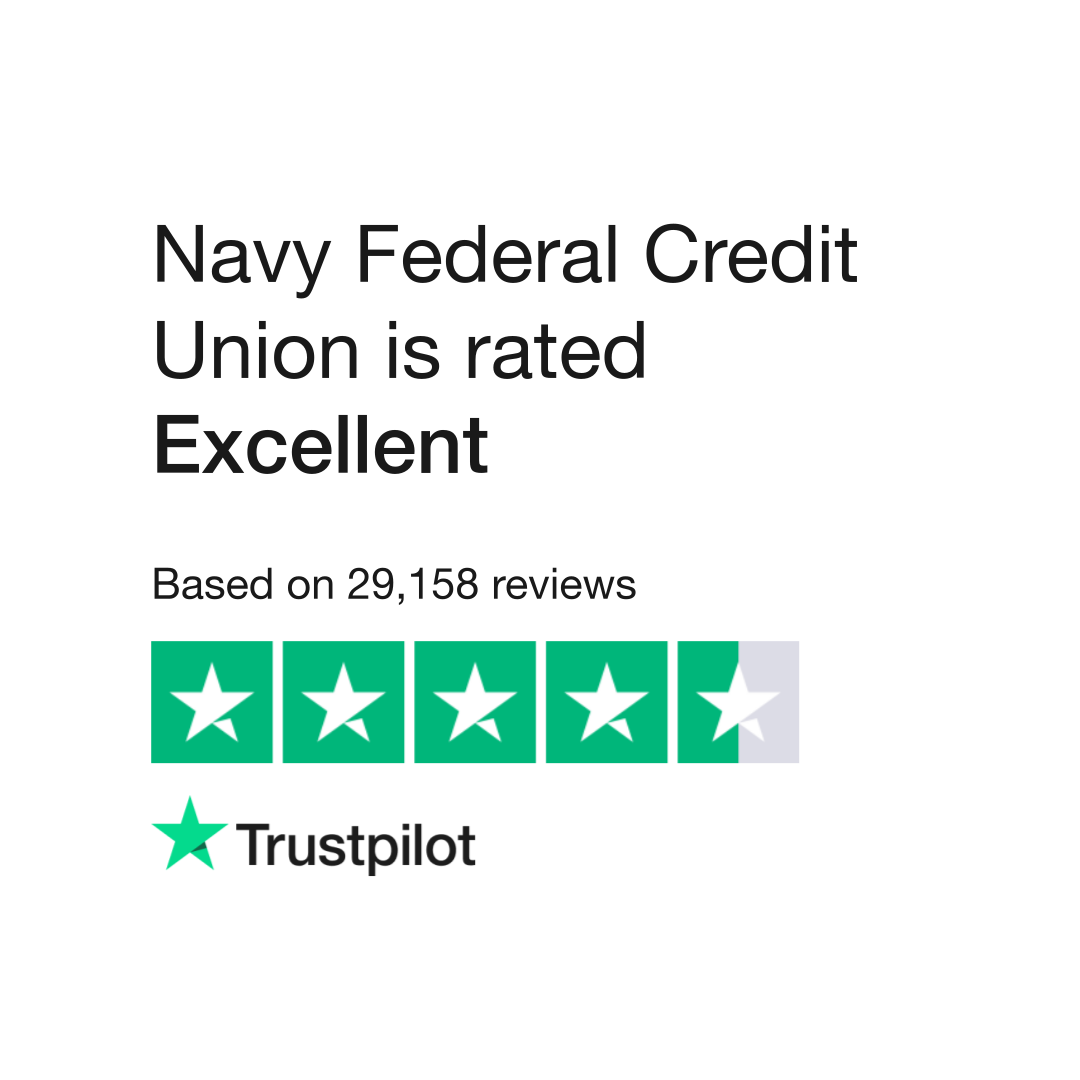

Another key aspect to consider is the lender’s reputation and customer service. Reading online reviews and testimonials can offer valuable wisdom into the experiences of other borrowers. Look for lenders who have a positive reputation for transparency, reliability, and sophisticated customer support.

If you are interest rates are an important idea, it is also vital to have a look at any additional fees and you will will set you back associated into loan. Certain loan providers may charge origination fees, closing costs, otherwise prepayment penalties. Carefully remark the borrowed funds words and inquire the financial institution to add an article New Castle loans on all potential costs and will set you back. This should help you make the best choice and avoid any unexpected economic burdens in the future.

Seeking recommendations from friends, family, or trusted financial advisors who have experience with appraisal-free home equity loans can provide valuable insights. They can share their personal experiences and recommend lenders who provided them with a positive borrowing experience. Additionally, some lenders may provide case studies or success stories on their website, showcasing how they helped borrowers go the financial requires. These case studies can give you a better understanding of how a lender operates and the type of service they provide.

Ahead of signing your choice, consider taking advantage of pre-approval options given by lenders. This process usually relates to offering the bank which includes very first pointers concerning your financial predicament, such as money, credit history, and the bills. Once pre-recognized, you should have a clearer picture of the borrowed funds matter you meet the requirements for and certainly will with full confidence means loan providers to discuss certain words and you will negotiate best prices.