Masters & disadvantages off Va house security alternatives

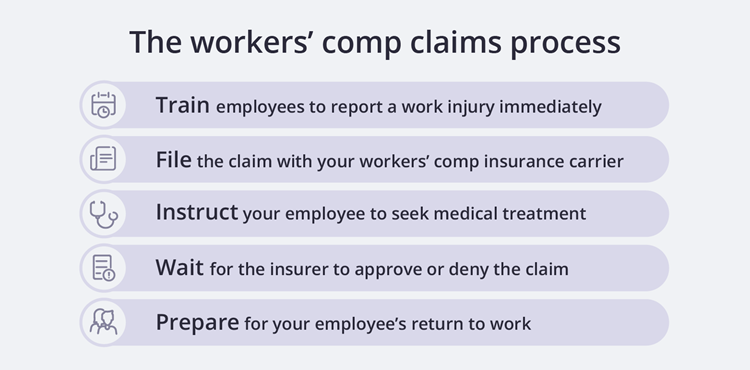

- Get a hold of a Va bank. Not all the loan providers give Va cash-away fund, so you will need to choose one that does. Essentially, you really need to evaluate costs regarding at least around three lenders just before committing.

- Demand your Certification out-of Qualification (COE). It confirms the facts of one’s military service. You could potentially demand they on the internet, from the post, otherwise during your lending company.

- Submit the job. It is possible to give your loan officer with all of records to have underwriting, including spend stubs, tax statements, and you can financial comments.

- Finalize the borrowed funds. The lender will take you step-by-step through the very last documents. Up until now, you can easily typically spend closing costs, including the Va financing commission.

- Verify their Virtual assistant cash-aside re-finance qualification

Do i need to rating a security loan with a Virtual assistant mortgage?

This new Va doesn’t give domestic security funds yet not Virtual assistant individuals have access to their home equity which have a separate financing, along with a Virtual assistant cash-away refinance or a low-Va second financial.

Really does the brand new Va enjoys a house guarantee personal line of credit (HELOC)?

This new Virtual assistant does not bring a home equity credit line (HELOC). Although not, you’ll be able to get a good HELOC which have a current Virtual assistant home loan.

Exactly what are equity reserves for the a great Virtual assistant mortgage?

Security supplies is yet another identity to own family security and you will describes the level of your property that you individual outright. Instance, for individuals who owe $100,000 on your own financial having property that is really worth $two hundred,000, then you’ve $100,000 for the equity supplies.

Do you really cure your home which have a house collateral loan?

Yes, you can cure your home when you yourself have a home equity financing given that loan providers usually put an additional lien on the home. Thus giving the lending company the authority to claim market your family for those who default for the home loan. A real home visit the site right here lien can last for the new entirety of your own mortgage term and you will expires once you pay the loan.

What’s the max LTV to own an earnings-out refinance?

The brand new Va allows you to borrow on doing 100% of your property equity – labeled as that loan that have 100% loan-to-worth (LTV). Although not, for each and every bank usually put their statutes rather than all loan providers assists you to borrow that much. You may need to research rates to get a lender who permits 100% cash-out refinances.

Could you re-finance an FHA financing so you’re able to an effective Va domestic security mortgage?

Even when your current loan isnt good Virtual assistant loan, when you find yourself an eligible Va debtor, then you may re-finance which have an excellent Va bucks-aside financing. There aren’t any Va home collateral money readily available, irrespective of your mortgage types of.

How come a house collateral loan work at this new Virtual assistant?

Given that Virtual assistant cannot offer property guarantee financing, qualified Va borrowers have access to their property guarantee that have a Va cash-away re-finance otherwise a low-Va 2nd home loan.

Ought i do a great 100% Virtual assistant dollars-out re-finance?

Sure, new Va lets being qualified Va individuals to help you use doing 100% of the house’s worthy of. Yet not, personal loan providers put independent criteria, and you will need to find a lender one to activities 100% Virtual assistant bucks-aside refinances.

How can i rating equity regarding my house rather than refinancing?

Borrowers who wish to supply domestic security instead refinancing their mortgage could possibly get the second financial, such a home equity loan otherwise HELOC.

The bottom line: House guarantee & Virtual assistant mortgage brokers

Home security financing commonly considering from Virtual assistant financing system, when you plan to seek the second financial, you’ll want to look around getting a lender. Nowadays, the best bargain can even become during your regional financial or borrowing union.