Just how After To get a home Do you Rating a personal Mortgage?

Basically, you won’t want to remove one the brand new debt when you are undergoing closure an interest rate. Therefore, whenever Could you Score a consumer loan Immediately after Purchasing a property?

Together with, after you’ve closed on financing, you truly should hold off three to six weeks before taking aside a personal loan.

Unsecured loans can be handy for home owners, as there are no certified rule that you can not get you to while you are wanting a house.

- Your credit rating may take a hit and you will affect the loan prices

- The debt-to-money ratio can get improve and affect the home loan qualification

- While you are already dealing with a lending company, they’re informed toward financing pastime

- You may impression their home loan qualifications no matter if you been cleared to close

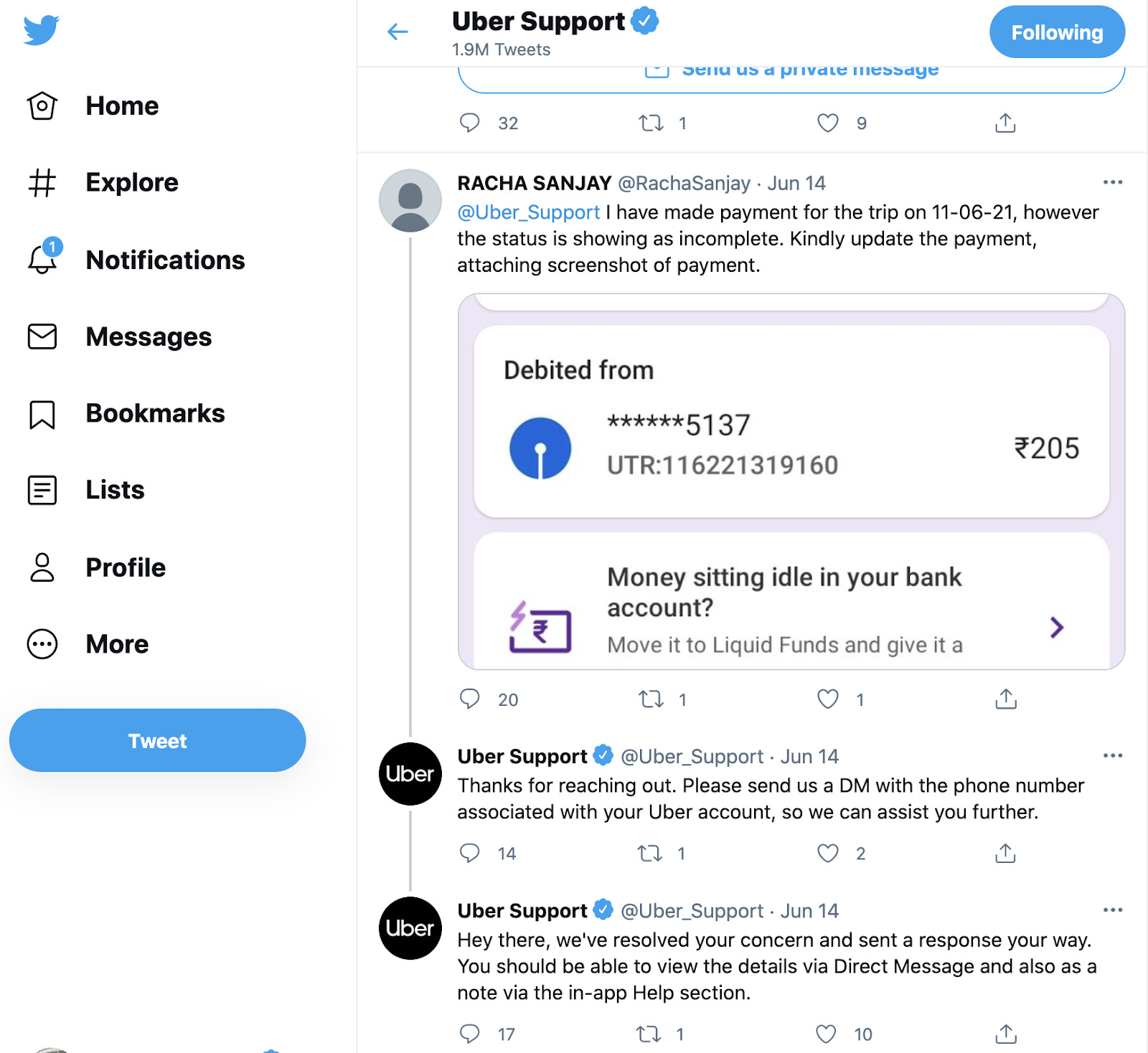

If you are nevertheless being unsure of off whether you need to sign up for a good personal bank loan when buying property, the following is an infographic that will help understand:

Should you get a consumer loan When selecting a house? Do’s and you may Don’ts

- Try to take out a consumer loan to pay for this new down-payment.

- Intend to borrow to pay for closing costs, checks, moving will cost you, etcetera. that have an unsecured loan.

- Take-out financing after all if you intend to make use of getting a mortgage in the near future, generally.

- Make an effort to hide consumer loan activity away from loan providers.

- Use an unsecured loan to own expenses such as seats, repairs, renovations, and you will non-home loan costs better once you’ve currently paid on your new house.

Expenses associated directly to the new business-eg appraisals, inspections, and off repayments-are best taken care of having dollars or of currency borrowed really on the lending company.

Observe that so it pertains to more than just signature loans. Even borrowing off relatives and buddies can occasionally provides unexpected outcomes. Once the commonly, financial pros remark debt passion to see how long you got your finances. One sudden large expands might have to feel told the new possible mortgagor, which could harm the probability so you’re able to be eligible for home financing.

Assist! I purchased a property and today I’m Family Terrible

In the event the mortgage repayments are trying out a whole lot more as compared to suggested twenty five% of one’s just take-house pay, you’ll be able to end up being financially constrained, aka family worst.

This can be a tricky problem to handle. Listed below are some details if you’re against a casing-associated overall economy:

While in Question, Pose a question to your Financial Manager

Personal loans may come inside the accessible to homeowners trying improvements or solutions. But they can be difficult to use alongside domestic-to order day.

Whatever the case, you can query the newest broker you will be handling in the event the bringing away an unsecured loan can be helpful. Per mortgagor varies and most want to make it easier to provides a profitable homebuying experience, so it is fundamentally beneficial to have confidence in its guidance.

Every piece of information inside article is actually for general informative intentions merely. Republic Loans does not make warranties or representations of every type, express or suggested, according to advice given inside article, such as the reliability, completeness, fitness, convenience, access, adequacy, or accuracy of information contained in this article. All the information contains here isnt supposed to be and you will does not make-up monetary, legal, tax and other suggestions. Republic Money has no accountability when it comes down to mistakes, omissions, or discrepancies on advice or people accountability as a result of people dependence placed on for example guidance on your part otherwise whoever will get feel advised of suggestions in this article. People dependency you add on the pointers within article is strictly at your individual risk. Republic Loans get site third parties within this article. A 3rd-people source doesn’t create support, association, partnership, otherwise affirmation of these third party. Any 3rd-group trademarks referenced is the property of its respective citizens. Your use and www.speedycashloan.net/loans/no-credit-check-installment-loans/ you may use of this blog, site, and you may one Republic Fund web site or mobile application is susceptible to our Terms of service, offered here.