Fed Price Hike; Improvements into Genuine-Time Costs; Truist Acquires Enough time Game

The newest Fed hiked of the 0.50%, but states big nature hikes are from the desk for now. Lenders break the rules with the nonsense fees. Improvements to the genuine-big date percentage sites. Area raises $115Mn for its home security platform. Affirm integrates having Fiserv. Klarna to begin with revealing so you’re able to bureaus throughout the U.K. Truist acquires gamified coupons app. Student loan forgiveness in the news again.

Which have inflation showing no signs and symptoms of reducing, the new Provided improved rates because of the 0.50%, according to standard. Given Settee Jerome Powell found so you’re able to relaxed segments of the making clear a huge 0.75% raise actually things currently involved.

Meanwhile, 10-year Treasury returns hit 3%, the greatest they’ve been since 2018. Ascending Treasury returns have determined cost with the anything from mortgages to help you student loans highest recently. Ascending home loan prices have previously substantially cooled originations volume.

Fundamentally, job spaces edged upwards when you look at the March, to eleven.5Mn openings. New hot jobs marketplace is giving team new count on to get rid of looking eco-friendly pastures. Some 4.5Mn specialists end their operate inside February, damaging the list place in November from this past year.

They argue that its misleading to classification charges for the all the individual facts with her while the nonsense costs. There is certainly little evidence to suggest charge was a life threatening supply out-of complaints, world supporters say.

As an alternative, community representatives state the current design out-of obvious and conspicuous disclosures, and therefore demands providing consumers factual statements about will set you back and costs upfront, is working as implied.

The newest Provided has started onboarding their very first take to profiles from FedNow, its real-big date commission system. Specific 120 teams was playing the latest demo, with users already revealing successfully connecting to your service’s try environment and you can providing demonstration messages. Multiple fintech companies are engaging in the new demonstration, and additionally Block’s Rectangular Financial Attributes and you may Q2 Holdings. FedNow is found on tune in order to roll out next year, depending on the Fed’s statement.

Exchange organizations symbolizing finance companies and you may borrowing from the bank unions was pressing back

Meanwhile, The brand new Cleaning House is partnering which have financial tech provider Fiserv in order to develop the means to access The fresh Clearing Home’s RTP network. Fiserv make the genuine-go out commission circle available as part of the Now Gateway, that enables associations in order to numerous payment communities.

Part, good house collateral platform, announced it offers raised good $115Mn Collection C. Westpac led the latest round, which have contribution from current people plus Andreessen Horowitz, Ribbit Funding, DAG Options, and you can Redwood Trust.

Point allows profiles to access collateral financial support in return for fractional possession within the property. Use instances become from the lifetime of buy and, for established people, since the an apparatus to help you cash-out domestic equitypared to antique personal debt things, for example a property collateral line of credit, Part allows residents availability wealth secured in their home, without the need for prime borrowing otherwise taking up the newest monthly payments.

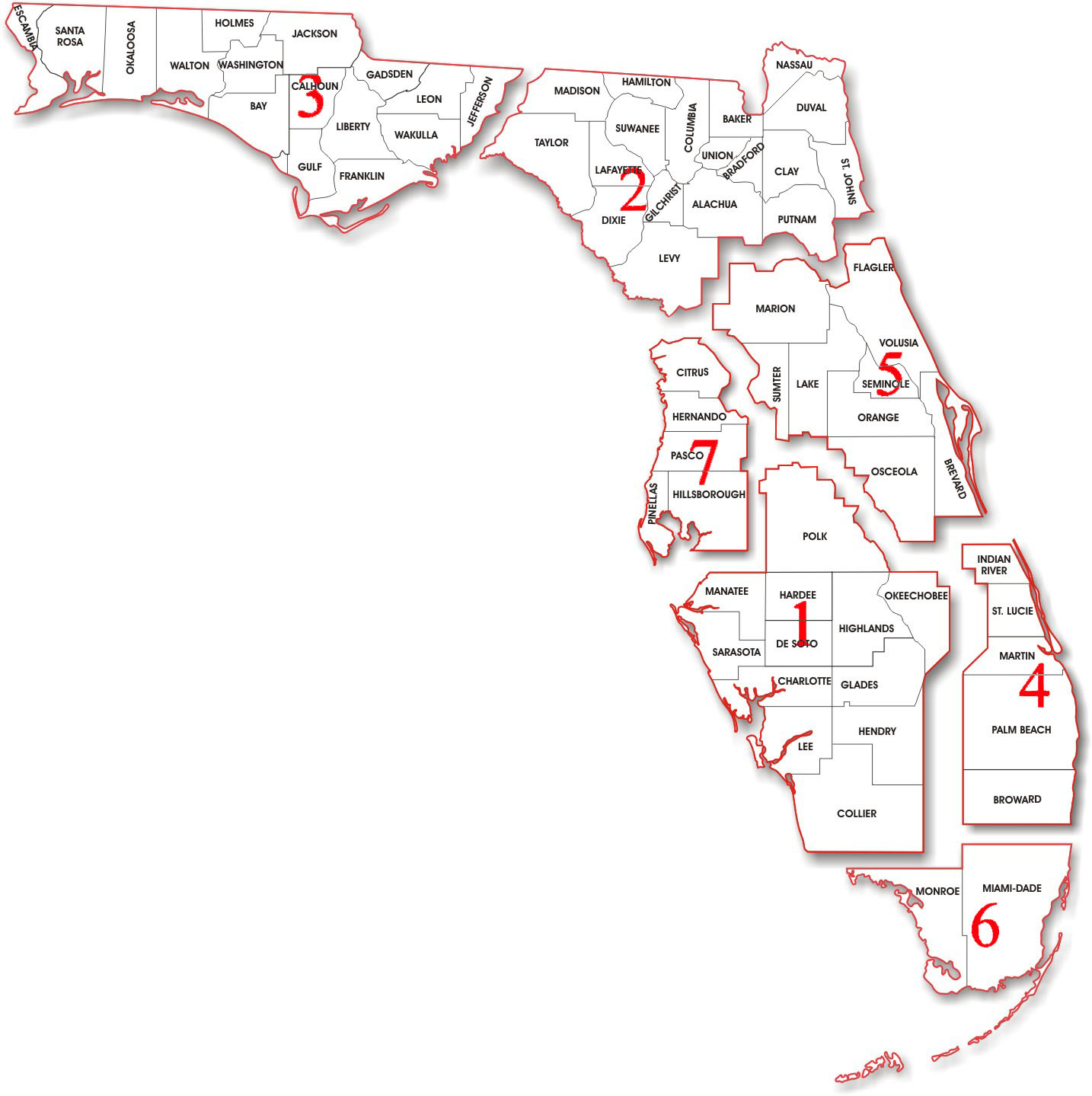

Point plans to utilize the new resource to carry on growing the flagship tool, that’s on the market today into the sixteen states and you will D.C., in order to create even more unit offerings.

Affirm and you may Fiserv launched your BNPL supplier could be the very first to completely consist of with Fiserv’s Carat systems. The partnership makes Affirm click for more info available to Fiserv’s firm provider customers later on this present year.

CFPB Manager Chopra recently affirmed during the Congressional hearings he agreements so you’re able to review components of the newest Cards Act, together with laws and regulations towards mastercard late charge and you may potentially most other issues

Meanwhile, regarding the U.K., BNPL large Klarna will start reporting borrowers’ utilize so you can credit reporting agencies birth Summer 1st. Klarna often report to TransUnion and you will Experian in the You.K. Customers’ scores are required to be impacted by the fresh new tradeline analysis over the 2nd twelve-18 months. The fresh move is available in progress from agreements from the FCA, the latest U.K.is the reason financial regulator, to cultivate regulations on the booming field.