Empowering a classic representative experience across avenues of preference

three days

Immediately after a part, constantly a member. Your life was the goal. For the majority of loan providers, taking for the such a powerful pledge may appear unnerving – occasionally hopeless. For Navy Federal Borrowing from the bank Relationship, it has been typical for more than 80 decades.

Navy Federal’s age-much time affiliate-concentrated achievements needs a couple of trick elements. Earliest was a group one eventually believes about organization’s specifications. While the Randy Hopper, elder vice-president out of mortgage credit put it, We are all focused on our professionals, and now we really do believe all of our people may be the mission.

Next, it will take the various tools necessary to make certain players get the better provider available to her or him, no matter where all over the world they truly are. This can be challenging from the truth one, given that Hopper informed me, Requirement try modifying, and in addition we must submit a heightened experience.

Once the criterion alter, so as well do the devices required to verify Navy Government continues on to incorporate world-category service. To handle progressing means, Navy Federal Borrowing from the bank Partnership hitched which have Mix so you can spearhead a digital conversion. With her, the 2 teams followed an electronic Lending System, strengthening borrowing from the bank connection team to provide an unparalleled associate experience across members’ channel preference.

Exceeding user standards which have an omnichannel device

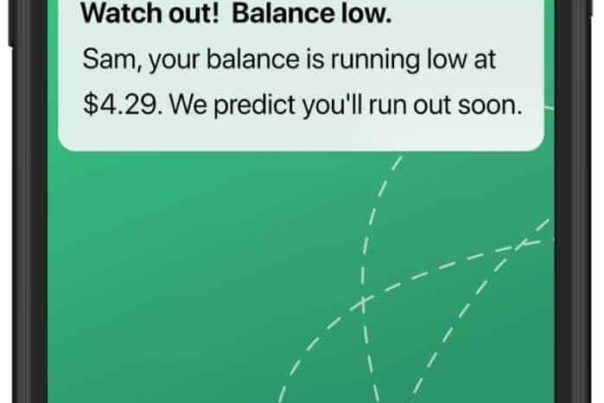

A key part of moving forward individual standards are an evergrowing consult to own personalized service. Electronic options for wedding – for example applications or on the web portals – bring an usually-into, flexible opportinity for users to interact using their borrowing from the bank commitment. All the more, yet not, that isn’t sufficient.

Due to the fact AVP from Financial Functions Mounia Rdaouni told me, Strategically, i place a whole lot of work on information our representative needs as well as their travels. New fruit of the work are a good nuanced understanding of member preferences: an electronic digital product that works well everywhere, each time, backed by this new encouragement regarding for the-individual or over-the-mobile relationship.

The players trust me to offer a way to link, no matter what average he or she is already playing with, said La Vinia Ferris, a mortgage manager.

Understanding the requirement for an omnichannel providing is one thing. Being committed and taking the steps to implement this product needs team-large trust and you will frontrunners intent on providing just what professionals require. It can also help to possess an event mate lined up along with your member-earliest purpose.

Mix really was wanting to show us what they you are going to create, detailed Hopper, and therefore is appealing to us just like the i desired to disperse easily. With over dos,000 staff, rapid implementation was key. While the platform’s very easy to use and simple to make use of, he proceeded, we were able to perform you to definitely from inside the a short period out-of day.

Navy Federal’s connection that have Blend underlines the main role you to definitely technology plays within the fulfilling its purpose. Of the implementing Blend’s Electronic Credit Platform, Navy Federal’s teams gathered the ability to promote an integral consumer experience in this new member’s station preference.

Rdaouni and her group want to clear up the method, speed up any sort of you’ll, and take off friction as much as we could in the act. Which have https://paydayloanalabama.com/ashland/ Merge, they’ve been capable of that.

Mortgage communities enable users to build lifestyle-long believe

An extremely important component of the success one an enthusiastic omnichannel toolset will bring stems from consumer empowerment. That have Merge at the fingertips, Navy Federal’s credit team are more effective in a position to improve members feel a part of your order, based on Noelle Davis, an LO.

It is particularly important by borrowing union’s spread associate inhabitants. Navy Federal’s professionals build a vow so you can suffice in which you serve, a hope that is all the more simple to satisfy as a result of Blend’s digital service.

If for example the professionals are overseas, they can access what are you doing, informed me home loan LO Prabha KC. They have been delivering a sense of possession.

Users has actually latched on to that it newfound sense of control. The display from notice-solution software possess increased significantly, Hopper proudly indexed. With 60% out-of programs getting started and you will accomplished because of notice-service streams, it’s clear that participants pick fuel in the power to steward its lending feel.

Exactly why are this new mind-serve process really unique is the ability to make pre-acceptance emails in minutes, maybe not weeks. Davis informed me you to other lender will not to able to track down you to definitely pre-acceptance page for a couple of or three days. Which have Mix, Davis and her class could possibly get it for the associate instantly, very they could complete their offer as fast as possible.

We can get [pre-recognition letters] toward user immediately, thus they can submit their offer as quickly as possible.

A partnership to own eternal representative time and energy

Due to the fact Navy Government Borrowing from the bank Commitment people seems toward 80+ so much more many years of best-tier solution, the relationship that have Blend ensures that they will be able to continually adapt to switching associate need.

Coping with Merge made certain that we was in fact section of an environment who does still progress with our company, listed Hopper. The audience is happy to go on a platform which enables development supposed give.

We during the Blend can be excited to have an effective lending companion to your the front you to definitely lifestyle brand new dedication to affiliate provider about what Mix is actually built. So you can 80 so much more many years, we state thank you.