Do We qualify for a great USDA mortgage?

I’m desperate to buy a property next 12 months. We come into the entire process of fixing borrowing. I’m interested in learning much more about the newest USDA financing and genuinely believe that this could be the best sorts of loan to own us once the we really do not keeps downpayment currency. The final piece of our cash on hand goes on the cleaning the last little bit of our very own credit up. I have a recently available credit score off 663 and you will my better half possess an excellent 600. I predict which to go up a great deal in the near future because of the finally cleaning on the the borrowing from the bank additionally the acquisition of an excellent the new automobile with financing out-of fifteen,000. I became told shortly after monthly payments try reduced punctually to it loan assume a beneficial leap into the the credit scores.

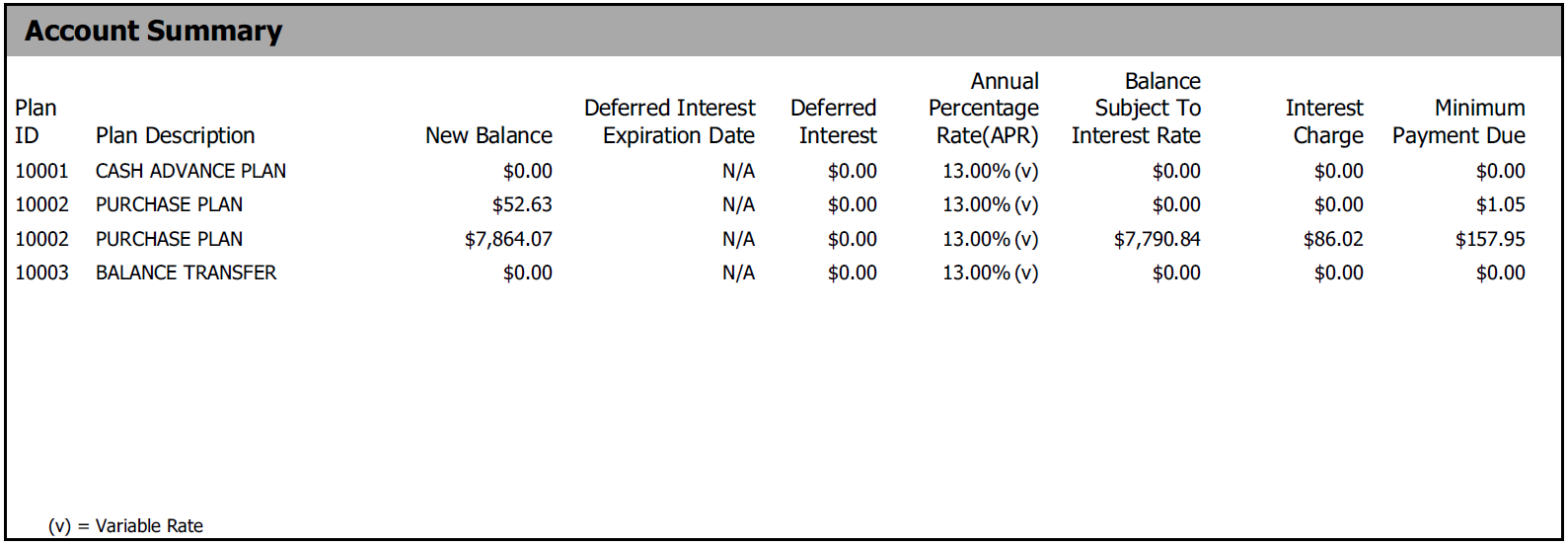

We generate thirty six,000 a year. My husband helps make 46,000 annually. I’ve a month-to-month car repayment away from . My hubby keeps each week child help repayments out-of . The two of us have a charge card (each) with smaller up coming full due each month. Mastercard repayments are formulated in advance of due date month-to-month.

Exactly how sensible is-it which i should be able to score a house in 250,000 range within the next 12 months? And you will, out of this brief snap shot of our own profit, does it feel like we would manage to qualify for a great USDA mortgage?

North Carolina installment loans

I’m hoping that somebody on the market will help me personally. Not one person in a choice of your parents enjoys ever ordered an effective household and we also are attempting the top with your limited training and make which fantasy come true for all of us and you can all of our youngsters.

Do We qualify for good USDA mortgage?

- united-states

- loans

- first-time-home-consumer

8 Solutions 8

IMHO you are in no updates purchasing a house. If this is actually me personally, I would payoff the latest student education loans, pay the auto, score men and women credit card balance in order to zero (and maintain them there), and you may save up at the very least 10K (just like the an urgent situation money) before even provided to find a property.

Now you may have zero push place. A somewhat minor issue with a paid for domestic can be send you right back to the trouble financially. You happen to be wanting to pick, your finances say other.

You may make a fabulous longterm monetary choice having zero chance: pay off those people credit cards and keep maintaining all of them paid back. Which is a much smarter choice following buying a home at the this aspect in your life.

For people who also qualify for a zero-downpayment USDA mortgage, hence I am not sure you’d. It might be very risky to adopt a beneficial $250K home loan and possess close-no collateral in your house to possess a good whenever you are. In the event that assets opinions get rid of after all you are going to be trapped for the reason that domestic and therefore more than likely keeps a pretty high month-to-month percentage, insurance, taxation, HOA costs, fix can cost you, etc.

My personal rule of thumb is that if you cannot show up having a downpayment, then you definitely can’t afford our home. Especially thereupon much personal debt holding more your face already. If a person biggest situation goes wrong with our house (roof, A/C, electronic, etcetera.) you are going to set your self inside the a world of hurt no obvious path off one economic trap.

My suggestion: Continue leasing if you don’t can afford to a down payment, even if this means downsizing their budget to possess houses your are thinking about.

Good 250,000 home loan in the newest cost for 30 seasons home loan is focused on $1560/mo. (included in this shape is the step 1% mortgage premium, the newest .4% annual percentage, the present day rates for a good 660 credit rating, the 2% products commission added at the front end of your own financial, typical closure costs put into exchange, and .5% commission for more than-mortgage insurance rates on basic 36 months because your financial often feel greater than the worth of our house due to these more fees)