Can also be People Get Signature loans and no Income Verification?

Possible get a personal bank loan and no money confirmation. Although not, it can be difficult to qualify for you to definitely because most lenders require a reliable money to secure a personal loan. In addition, it may not getting a good notion to place your economic health on the line if you fail to manage to pay the loan.

Luckily for concert https://simplycashadvance.net/loans/high-risk-loans/ savings experts which have changing money, specific lenders allows you to sign up for a loan no earnings or enable you to explore low-a career earnings. Prior to your make an application for you to definitely, you should research thoroughly and you may look at the positives and you may disadvantages of getting that loan instead of a constant money.

Exactly what do You would expect When you Submit an application for Loans Versus Income Consider

The method while the conditions are different when obtaining a beneficial unsecured loan to possess care about-working no evidence of money. In the place of guaranteeing your income, the brand new loan providers could possibly get check your personal credit history.

For the lenders, good credit means that you’ve got a reputation investing obligations promptly, making you less of a risk having standard or non-payment of debts. While this alone cannot be sure loan recognition, an excellent credit history items your on best guidelines.

As an instance, lenders usually charge straight down rates of interest for those who have a good good credit listing. This permits you to definitely save money on the debt payment expenses, which should be your aim when obtaining no income confirmation unsecured loans.

Other than thinking about your credit score, loan providers you are going to ask you to vow or perhaps establish evidence of a valuable asset used due to the fact equity, such as your auto otherwise possessions. You must illustrate that you or perhaps the financial can be liquidate so it house to your bucks to settle your financial obligation in case there are a standard. This new disadvantage from pledging equity when applying for signature loans no money verification is the chance of shedding you to definitely house any time you are not able to repay the loan.

In some cases, loan providers will want to protect by themselves because of the asking in order to designate a good guarantor or co-signer into financing. This guarantor is essentially be somebody who will present a stable earnings. Just like guarantee, demanding an applicant in order to hire a great co-signer covers the loan providers regarding monetary losings. For individuals who default, they realize the co-signer alternatively.

Some lenders also are ready to assist those with no money and an exceptional credit history borrow money. not, the fresh amounts available is significantly below men and women offered to people with secure income and you may a good credit score score. Lenders may costs extremely large interest rates to help you offset the exposure.

Lastly, loan providers you may require proof alternative money other than your primary concert. These include Personal Defense pros if you find yourself retired, returns from your own assets, and you may personal guidance funds, among others.

Getting ready to Make an application for Finance And no Earnings Confirmation

Having care about-operating someone, it is just a point of day till the have to seek investment pops up. As you work at your company, it’s also possible to in the future encounter openings which make it difficult for you to settle utility payments, gadgets restoration, and staff payroll if you get work.

You should be able to get debt statements in check before you even need borrow cash. Yours financial statements offers possible loan providers that have proof of normal or, no less than, repeated money. Collect ideas of your own revenue statements and money circulate which go right back at least 90 days. This can be including a way to evaluate in the event your business is indeed in good shape or perhaps not.

You might demand a duplicate of your own credit score and you may rating regarding the three credit bureaus having a charge. Utilize the pointers to the office to the enhancing your credit history. You can start by paying one or a couple of your existing funds on time as much as possible. You are able to choose problems from the account, so you’re able to rectify her or him while increasing your credit score.

When it’s time for you apply for a consumer loan no income verification, you’d been employed by at and also make your credit score as much as you’ll be able to.

Before applying, you will additionally need to pick a secured item that you may guarantee just like the guarantee when necessary. A basic option is our home home loan or perhaps the home itself. But not, you and your partner must’ve generated significant money towards house’s collateral before you borrow secured on the mortgage. Most other practical possibilities include the term on your auto, if this has been totally reduced or perhaps is perhaps not used because the equity in another mortgage.

Choice Resources of Finance To have Funding with no Earnings Confirmation

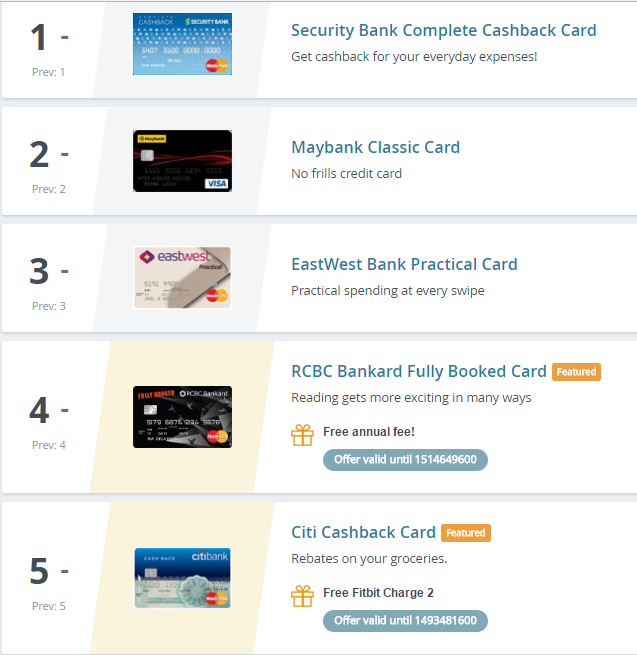

- $five-hundred in order to $5000 money

Online credit networks provide signature loans to gig savings workers who earn 1099 income. You can buy immediate access so you can investment for $5000, which you can use to expand your online business. Lender conditions are very different, you need to be care about-working and show a work reputation of at the very least 3 months with monthly money greater than $3000.

- Friends

One way you can get that loan rather than earnings confirmation is via asking your friends and relatives for one. Before you obtain the bucks, make sure you put this new small print of loan. When you find yourself this type of purchases may or may not encompass a contract, you may want to err to the side away from alerting and you will set up a proper offer to safeguard the latest welfare from each other activities. The fresh new contract will be explanation new fees process, agenda, and interest rate.

Which option variety of resource takes into account your revenue record and you will charge you only a particular portion of your profits since the cost. This is certainly the same as a seller payday loan it is perhaps not limited to mastercard purchases simply. Lenders tend to get acquainted with your own banking comments, ount it does enable you to borrow, and you can auto-debit your payments from the checking account every month unless you completely afford the mortgage.

Final thoughts

You can get a consumer loan without earnings verification, nevertheless may need to take on large rates of interest, the new pledging of collateral, and you will a strict processes.

While doing so, self-functioning individuals must believe option types of funding one to none of them a good or a good credit score score. They truly are relatives fund, Automatic teller machine cash advances, crowdfunding, and many others. Such non-antique financial support can be as convenient into the an economic crisis as loans and other conventional types of financing.