Another way from resource good fixer upper is to find an excellent domestic collateral personal line of credit

- No larger than a two-equipment no. 1 quarters

- Performs must be complete within 6 months

- Restoration work must begin within a month of assented go out

- Money can not be useful luxury items

- A broad package having licenses must do the task

- Assessment report should defense as-completed worthy of

The fresh new 203(k) mortgage have a wide extent, since the possible good reason why people stop fixer uppers – the question out of where you can real time in renovation. From the 6-day works achievement maximum, a debtor can be discuss housing costs to reside elsewhere when you look at the the brand new meantime. The application form may also be used to possess refinancing existing characteristics.

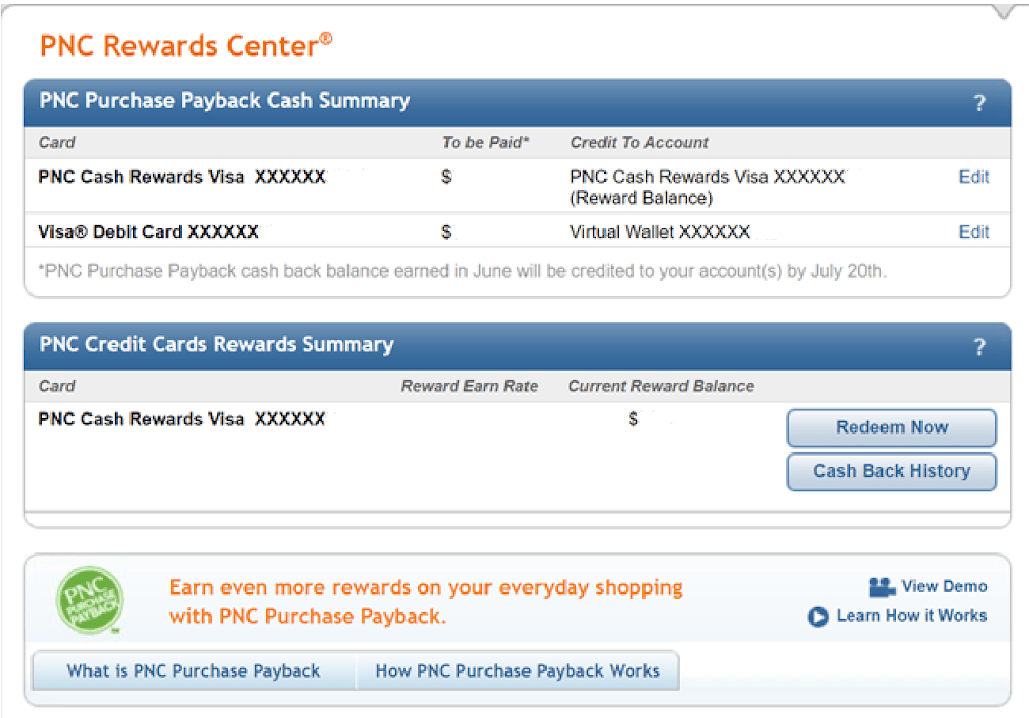

Capital Good Fixer Higher: HELOC

![]()

In this instance, you should be mindful and make sure that you will alive at your home for quite some time. Or even, you could find your self inside the more your face to your home loan in the event your market injuries.

Nevertheless, good HELOC also provide an effective homebuyer with cash into family upgrade and get let them play with domestic equity to own resolve costs. As a whole, a great HELOC rate of interest is a lot more than a routine much time-label financial.

If you choose good HELOC, make sure to browse the conditions and terms. Get a hold of pre-percentage charges, how much time you can keep the credit unlock, or other techniques.

Build Loan

An alternate opportinity for resource good fixer upper is getting a property financing. Design fund are typically approved to possess a opportunity, however, if you’re looking to completely renovate brand new fixer upper, the borrowed funds you are going to verify yours provides full borrowing strength.

The lending company do give you currency with a homes loan, that would getting in line with the appraised as-completed worth of the long term house.

Normally, a homes financing features secured rates for six to help you 1 . 5 years. After that timing, you’d spend interest only to your count repaid by the bank on the loan issuance.

Whenever framework is in the long run done, the lending company manage key the development mortgage to help you a typical financial. You might like to try a contrary financial, that would help you get more cash out of your current home.

Refinance Latest Home

If you own a current family, you can refinance it. If you’ve been located in your house for a long period, therefore you need of a lot updates, this is certainly the fresh golden window of opportunity for your.

Refinancing is not for the homeowner, let’s be honest. You really must have considerable equity home just before also given they. And you also would have to be really careful and keep a great close eyes to your value of our home even though it alter towards the business.

Due to their the usage of a cash-out refinance will assist rating less interest, so that you can begin concentrating on brand new fixer top instantaneously.

If you choose to go so it route, be sure to take note of the altering terms of the newest refinance loan. Are you extending the borrowed funds to around thirty years in the event you paid multiple from the newest home loan? Can you select a smaller mortgage label or a down interest rate, and possess the same monthly premiums?

Oversight & Assessment

One more thing to think is the fact that the recovery fund need www.clickcashadvance.com/installment-loans-la/ even more appraisal and you can oversight. These are constructed with the newest lender’s resource in your mind, and your individual.

For example, the quality FHA 203(k) demands your due to the fact homebuyer to employ the services of a beneficial associate regarding Company of Casing and you will Metropolitan Development. Which consultant commonly manage builder arrangements, agree preparations, search the house or property after every completed phase.