Cost of Production Report Managerial Accounting Vocab, Definition, Explanations Fiveable

Each month, the data at the top are changed to reflectthe current month’s activity, and the production cost report takescare of itself. You can look into using different suppliers to source your materials at a lower rate. Or, you could explore ways to make your production processes more efficient. Price increases aren’t always necessary if you have concerns over production costs.

- To determine the average cost, you simply divide the total cost of production by the total unit of output.

- The beginning inventory of 750 plus the 3,250 pie shells worth of materials placed into production during the month gives us 4,000 total units to account for.

- 24,000 units were received from the first department during May. 14,000 units were completed and transferred to the finished goods store room, and 10,000 units were still in process at the end of May.

- Or, you could explore ways to make your production processes more efficient.

- Rounding the cost perequivalent unit to the nearest thousandth will minimize roundingdifferences when reconciling costs to be accounted for in step 2with costs accounted for in step 4.

Great! The Financial Professional Will Get Back To You Soon.

Plus, they’re going to help determine the final price point that you offer your product or service to your customers. When you produce an additional unit, you’re going to see an incremental increase in independent your total cost. This is the marginal product cost and they’re most often related to variable costs. When you produce a product or service, production costs are any expenses incurred along the way.

Review Questions

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Therefore, there will generally be some work-in-process inventories at the end of each month.

Do you already work with a financial advisor?

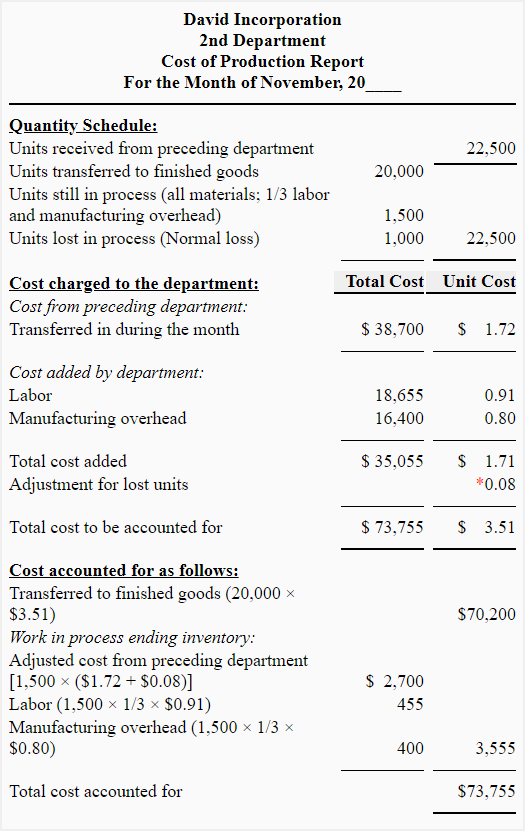

This KPI analyzes and compares similar equipment, production lines and manufacturing plants. It’s calculated by dividing the total number of good units produced by the specific time frame. A manufacturing KPI is a metric to understand the efficiency of the production process. It should reflect strategic goals, be quantifiable and measurable, but also attainable and actionable. The following is a project report example of those fundamental manufacturing KPIs that production managers track. The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9.

To keep things simple, production costs are expenses incurred when producing your product or service. Manufacturing costs, on the other hand, relate to only the expenses that are required to make your product or service. Fixed costs might include equipment, warehouse rent, labor, and utilities. You would add these costs together to determine the total cost and find average and marginal costs. Once you find out your production costs using the first formula outlined above, you can divide it by the total number of units produced during the same period.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Unfinished units (work-in-process) in this department have to be converted to Equivalent Units. Production reports are tracking efficiency and one way to improve efficiency is by planning resources better. Production reports are only one piece of the larger picture that makes up manufacturing and the management of those processes required to create a commodity. For those who want to add more complexfeatures, the basic data (e.g., the data in Table 4.2) can beentered at the top of the spreadsheet and pulled down to theproduction cost report where necessary. And they always stay the same regardless of the number of products or services you produce.

It’s all going to depend on the type of product or service and the industry that you’re in. The main component of production cost is prime cost, also known as direct material and direct labour. Factory overheads, considered secondary to prime costs, are all indirect expenses related to factory management including cost of machine Depreciation. Production cost is also known as factory cost and cost of goods manufactured. This figure is presented in a special ledger account called the manufacturing account.