Consumers may have confidence in mortgage officers and you can home loans to determine what type of financing is best suited for the consumer’s requires

This new Bureau depends on data throughout the 2007 and you will 2017 Financial Census to help you estimate just how many low-depository associations, plus lenders, you to definitely functioning loan originators ahead of the implementation of this new Board’s 2010 Laws while the level of establishments currently susceptible to the fresh Regulation Z Financing Maker Guidelines. When you look at the 2007, there were 20,625 mortgage brokers, 20,393 from which was brief with regards to the SBA’s current size conditions. An equivalent season, there had been 10,539 non-depository collector establishments you to definitely started mortgage loans, 10,206 where were short. The new Agency takes on that ( print page 16203) all these low-depository institutions are at the mercy of the principles. The newest low-depository financial community is served by knowledgeable big combination over the last ten years. In 2017, exactly how many home loans decreased of the 67 % so you can six,809, at which six,670 was in fact brief. Furthermore, the amount of non-depository creditor organizations , where dos,904 was brief.

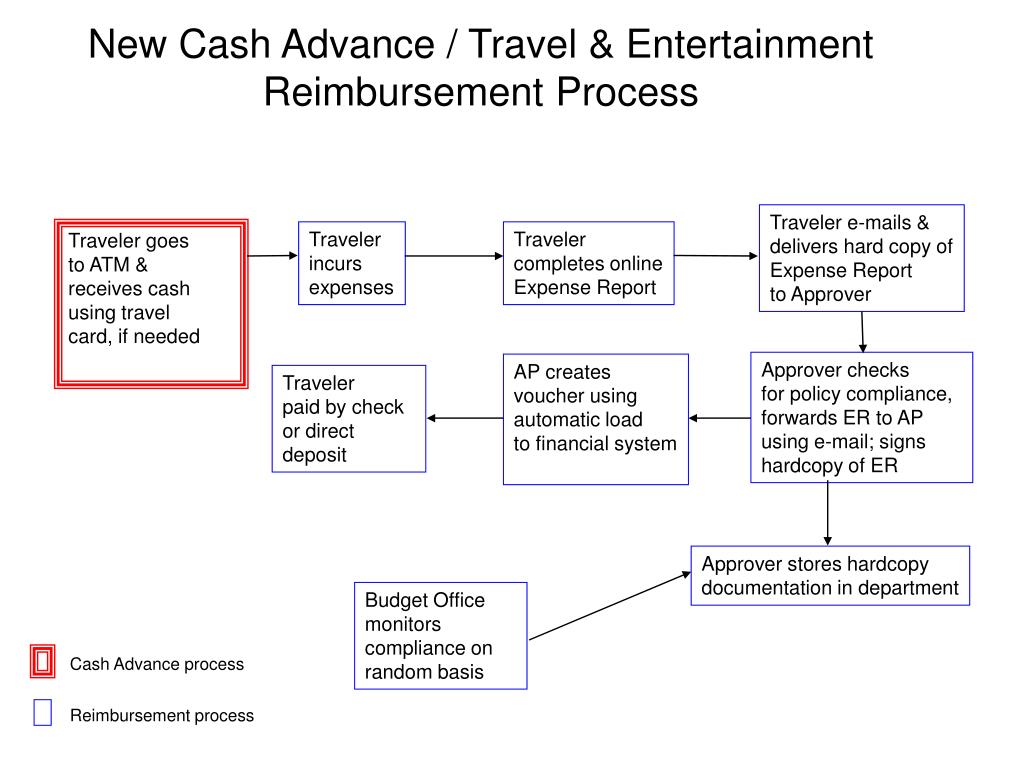

dos. Financial Origination Process

Inside a shopping deal, the user works closely with financing administrator who’s a single loan creator used by the newest creditor, such as a lender, credit partnership, otherwise non-depository creditor. The new collector will get jobs a network away from branches or correspond with people through mail, the web, otherwise by the phone. The complete origination transaction is completed inside corporate construction regarding the fresh creditor, as well as the mortgage is finalized using loans supplied by the newest creditor. With respect to the brand of creditor, the newest creditor can get contain the loan inside profile or offer this new mortgage so you’re able to buyers towards supplementary markets, as the talked about after that below.

In the a general deal, the consumer works closely with one financing originator that’s a beneficial home loan brokerage firm or employed by such as for instance home financing brokerage firm. Essentially, the brand new general origination route include loan providers one to use independent 3rd people to do the fresh new commitments from financing creator, whereas the latest shopping channel consists of creditors one to make use of group so you can perform such responsibilities. Given that, relating to a general deal, the loan broker operates since a third party, the borrowed funds broker tries also provides out-of various financial institutions, immediately after which act as a great liaison amongst the user and you may any collector ultimately closes the borrowed funds. Fundamentally, on closing, the loan is actually consummated utilising the creditor’s money, therefore the home loan mention is created in the creditor’s label. This new collector may contain the loan inside the portfolio otherwise offer the new mortgage into the additional market.

The key mortgage origination field, and therefore surrounds the latest interaction of the consumer with the loan maker, will be generally split up into two types of origination avenues-shopping and you may general

Each other merchandising financing officials and you may home loans offer information to customers in the different varieties of financing and you will indicates people toward choosing an effective mortgage. Loan officers and you can mortgage brokers as well as just take a consumer’s completed mortgage software for submitting on creditor’s loan underwriter. The applying comes with the newest buyer’s borrowing and you will income pointers, along with factual statements about the home for use once the guarantee getting often a buy otherwise refinance. Customers can perhaps work that have several mortgage originators evaluate the mortgage even offers a loan originators can get see on their behalf of creditors. The loan creator otherwise creditor can get consult details or files throughout the consumer to support the information throughout the application and you will see an assessment of the home. Once origination, the method to possess underwriting and you will mortgage closing generally takes place with the creditor. However, new shopping financing manager otherwise mortgage broker generally functions as the brand new liaison for the consumer on techniques.

As stated, after financing is signed, the loan collector just who generated the borrowed funds often from shopping otherwise wholesale origination route will get secure the financing inside the profile or promote the loan into the secondary industry. To do this, the new creditor can get offer the entire financing to another home loan company or buyer in what is called a great correspondent product sales, or perhaps the collector may put the loan into a protection so you can feel in love with this new supplementary industry. A purchaser of good correspondent marketing loan may place the mortgage towards a security to be released. In the present industries, a lot of funds began try at some point put in Mortgage Supported Bonds (MBSs) in the new additional industry. When a collector offers financing into supplementary markets, the collector is exchanging an asset (the loan) which makes regular cash moves (dominating and appeal) for an initial cash percentage from the visitors. The newest upfront bucks payment Ocean City loans means the latest consumer’s introduce valuation of the loan’s coming dollars circulates, having fun with presumptions regarding rate regarding prepayments due to possessions conversion process and you may refinancings, the interest rate of asked defaults, the pace from return in line with other expenditures, or other points. Additional industry people imagine significant chance from inside the deciding the price it are able to purchase financing. In the event that, such, loans prepay shorter than just questioned otherwise standard from the higher pricing than expected, brand new trader are certain to get less get back than just questioned. In contrast, if funds prepay far more reduced than simply asked, or default during the all the way down rates than requested, new investor usually secure a higher go back through the years than simply questioned.