8 Inquiries You need to Address Prior to Scraping a home Equity Loan

Are rebounding home values enticing one to use the guarantee inside your property since an automatic teller machine? Inquire this type of issues first.

Adverts Revelation: After you buy something from the pressing backlinks on the our very own webpages, we possibly may secure a small percentage, however it never affects the merchandise otherwise properties i encourage.

You’re snowbound today, however, spring season is approximately the fresh part. Which have domestic-update tactics looming, expectation off june trips growing or expense merely mounting up, many people are looking at just how they’re going to pay money for every thing.

Rebounding home prices will get tempt many to gain access to their houses while the prospective ATMs. Home values, generally up just like the Higher Credit crunch, rose 6.step 3 per cent regarding 1 year by way of , brand new Federal Reserve Financial of brand new York states.

While they’re tapping security once more, home owners are wise, Todd Pietzsch, spokesman to have BECU, Washington nation’s premier credit partnership, said when you look at the a job interview, echoing comparable findings payday loan Redding Center throughout the nation.

Whether or not almost one million people into the 2015 refinanced their homes in order to take-out normally $sixty,100000 when you look at the dollars, it failed to use as much as they might keeps, claims Black colored Knight, a financial attributes organization you to analyzes mortgage analysis.

Fiscal experts say there are wise indicates and you will dumb an easy way to have fun with home loans. Let’s view things should ask yourself first.

step one. As to the reasons am I borrowing from the bank?

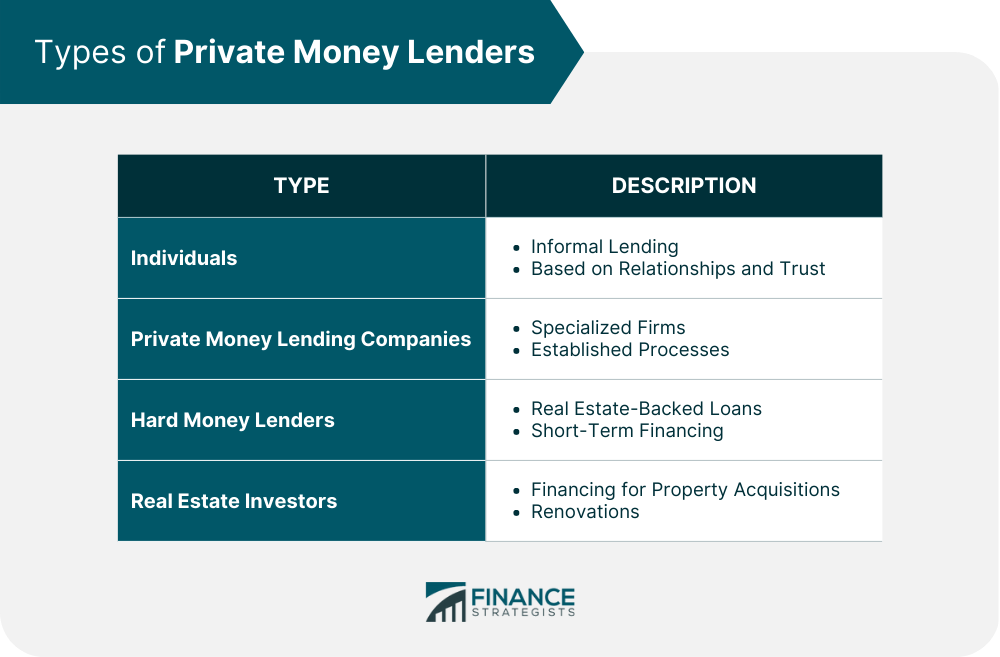

Over the years lowest prices imply property security loan or type of credit is a great idea, offering the cash is being used having a valid goal, one that will eventually enhance your web worthy of, suggests Money Discussions Information economic professional Stacy Johnson. The last thing you want to do, however, are make use of your house equity for example a money box to live outside of the form.

To compliment yourself, the initial question you need to query, states BECU spokesman Pietzsch: Just how usually getting this loan circulate me closer to my financial requirements?

Borrowing toward dream travel or other items that will simply depreciate quickly might not be the best the means to access that loan, he says.

Everything you select, has a payment plan and you may keep in mind that attention costs, depending on financing terminology, could well be a larger expenses versus count your obtain.

dos. Is actually my personal home improvement project beneficial?

While the home prices has actually improved, people has actually guarantee that they’re placing to make use of for taking proper care of some of the things that they’d to get out-of until houses pricing rebounded, Pietzsch told you. Detailed with home improvements eg a different sort of roofs, kitchen remodels and deferred repair.

Although you may prefer to keep your home with a new rooftop, specific do it yourself projects pay larger, however, other people can actually damage your property value.

3. Ought i combine debt?

If you’ve run up highest-desire borrowing-cards obligations, you may be inclined to rating less-interest home loan which is normally tax-allowable to settle your debt which have you to definitely quicker invoice.

The new mortgage percentage could be lower than the old month-to-month expenses joint, releasing upwards bucks to possess rescuing or to purchase fundamentals.

The challenge: A lot of people embark on using in ways one had her or him inside troubles to begin with. If you wade this route, envision closing most profile and you can reducing upwards all except one borrowing from the bank credit to utilize into the a bona fide crisis. Or you might find oneself seeking pay back our home loan at the same time you might be seeking to match new personal debt payments.

For those who get behind to the financial your grabbed to help you consolidate debts, you happen to be vulnerable to losing your home.